Macro Kernel - 31st May

Notable Today

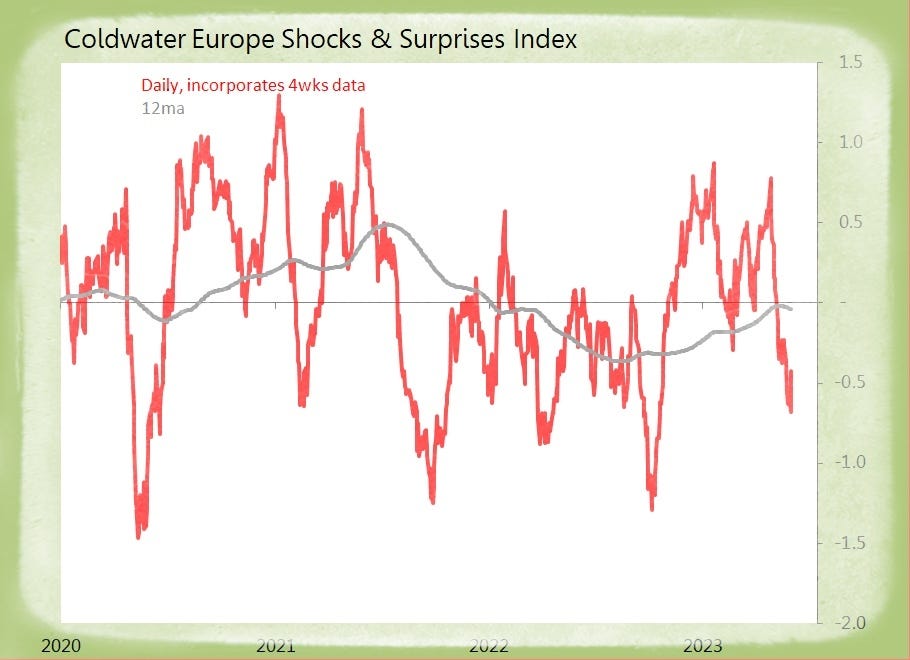

When a day single day generates around 50 datapoints, regional patterns emerge fairly unavoidably: the story today was of weakness in Asian production and demand, countered by a swathe of surprisingly mild inflationary results from the Eurozone.

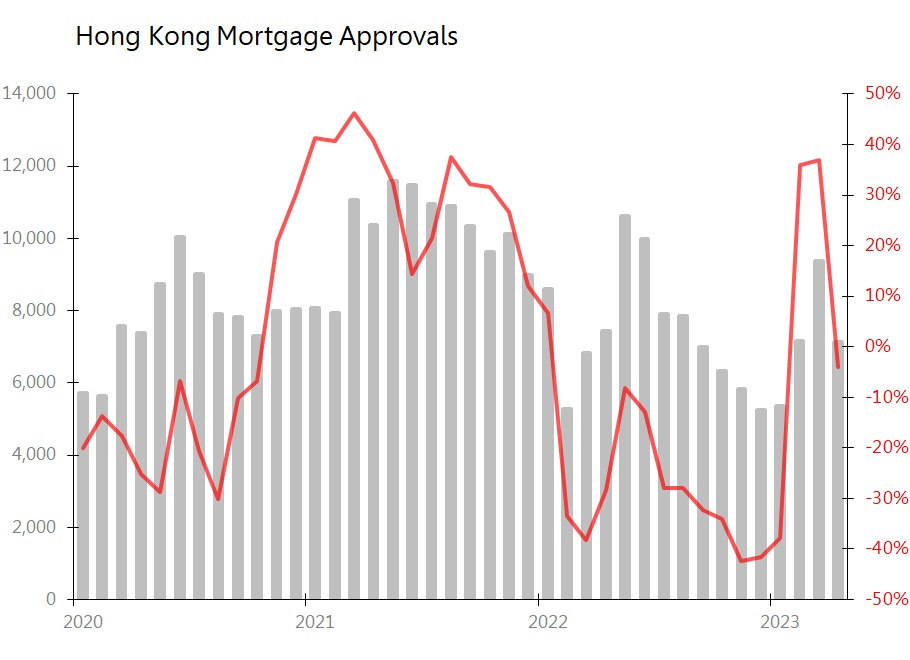

Within that general pattern, a couple of datapoints stood out: in Hong Kong, the 4.1% yoy decline in mortgage approvals (and 7.2% yoy fall in capital lent) was 1.7SDs below historic seasonal trends, and cancels the recovery seen in the previous two months.

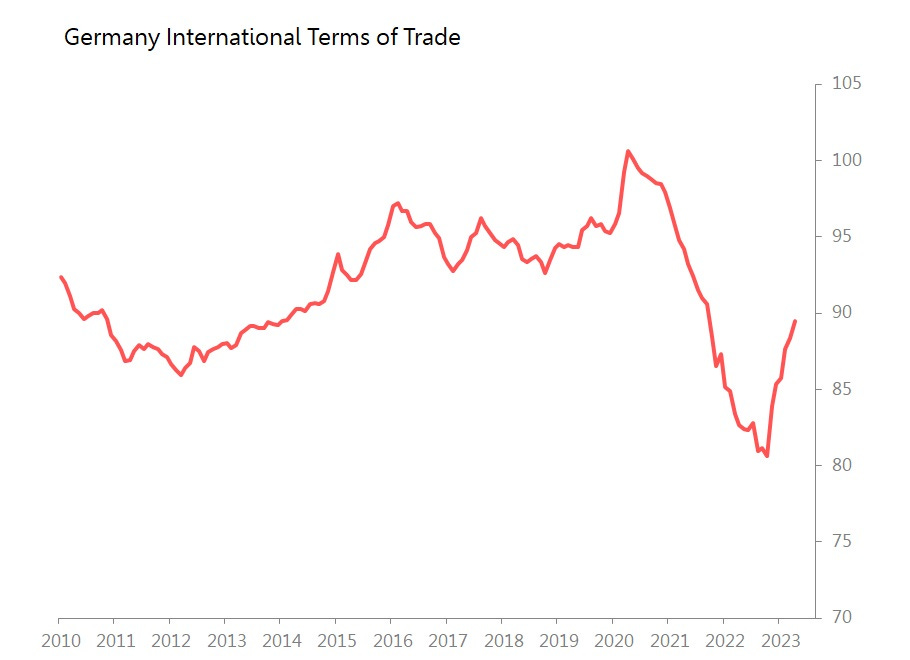

And in Germany, the 1.7% mom fall in import prices combined with a fall of only 0.4% in export prices means the recovery of the recently collapsed terms of trade continues. Germany’s terms of trade improved 1.3% mom and 8.3% yoy, which is enough to return them to within touching distance of the long-term average.

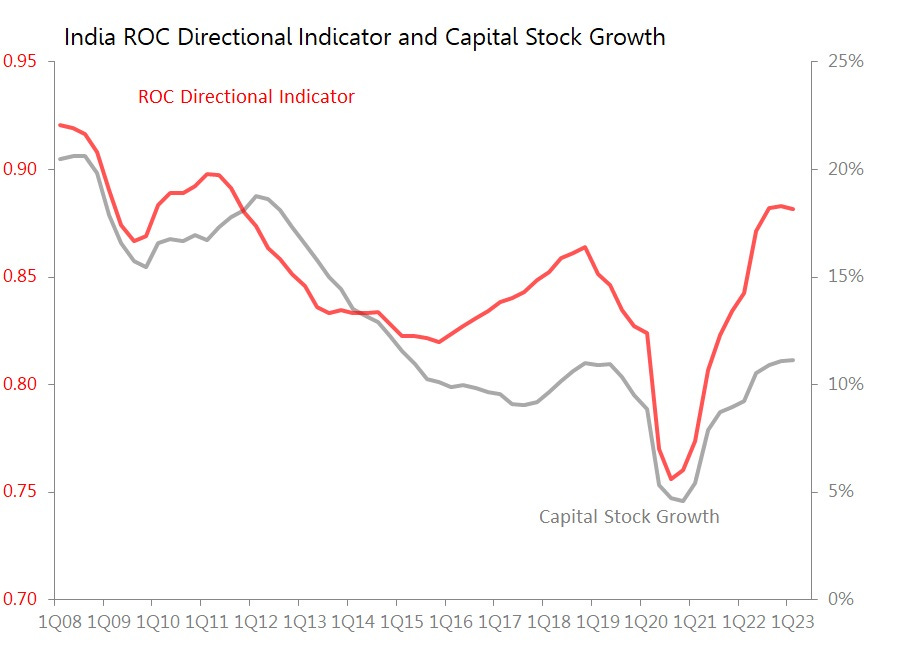

India’s 1Q GDP - Very Familiar Asian Growth Pattern

India’s 6.1% yoy GDP growth was generated by a sequential recovery in momentum, after the mild disappointments of the previous year’s results. The growth was fired primarily by

gross fixed capital formation, which rose 8.9% yoy and contributed 3.,1pps to the 6.1% yoy growth.

net exports, which 1.4pps to yoy growth as exports rose 11.9% yoy whilst imports rose only 4.9%.

Meanwhile, private consumption rose only 2.8% yoy (adding 1.6pps growth) and government consumption rose only 2.3% yoy (adding 0.3pps to growth).

This combination of rapid growth generated by investment and net exports will be familiar to anyone who watched the rise of Asia’s economies during the 1990s and 2000s.

The rise in investment, however, has resulted in nominal capital stock rising by 11.2% yoy, which is slightly faster than the 10.4% yoy rise in nominal GDP and the 10.5% yoy rise in final spending on domestic product. As a result, the return on capital indicator (ROCDI), although it at levels not seen in a decade, is now in very modest retreat. If this continues, it will eventually provoke slower investment spending. (Note also that current cyclical dynamics in capital spending closely resemble those of the US.)

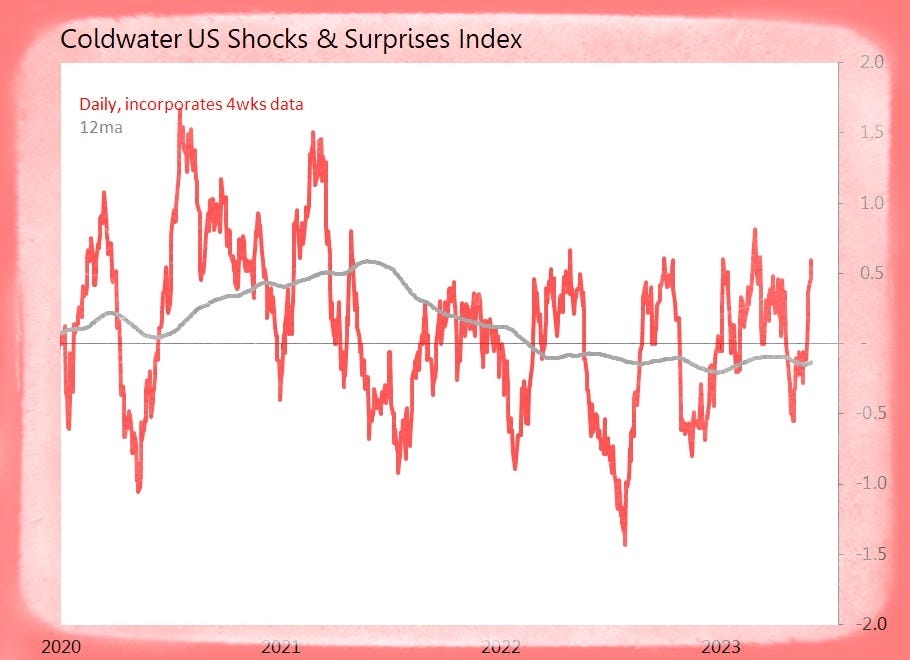

Summary: 45 datapoints crowded in today, generating nine shocks and eight surprises. The wash of data has had little impact on the state of the global index, which remains fractionally negative.

US (3 tracked)

Shock! May Chicago PMI Slumps 8.2pts to 40.4

o Worst Since Nov 2022

o Falling Faster: New Orders, Production, Backlogs, Inventories

o Supplier Deliveries Rise Slower, Employment Falls

o Prices Paid Rise Less

Surprise! April JOLTS Job Openings Gain 358k to 10.103mn

o Openings Rate Rises 0.2pps to 6.1%

o Private Openings +430k, Govt Openings Down 71k

o Hiring: Retail +209k, Health & Social +185k, Transport/Warehouse/Utilities +154k

o Not Hiring: Leisure & Hospitality Down 86k, Prof & Business Servs Down 57k, Durables Manufacturing Down 40k

Europe (14 tracked)

Surprise! Germany May CPI prelim Rises +6.1% yoy Only

o Monthly Fall of 0.1% mom is 1.2SDs Below Historic Seasonal Trends

o Goods +7.7% yoy, with Food +14.9%, and Energy +2.6%

o Services +4.5% yoy, with Rents +2%

Surprise! Germany April Import Prices Drop Down 7% yoy

o Monthly Fall of 1.7% mom is 1.4SDs Below Historic Seasonal Trends

o Energy Prices Down 6.6% mom and Down 31.8% yoy

o Prices ex-Energy Down 0.7% mom and Down 0.6% yoy

o Intermediates Down 6.5% yoy, Consumers +4.6%, Capital Goods +4.7%

o Export Prices Down 0.4% mom Only, so Terms of Trade Improve 1.3% mom and +8.3% yoy

Surprise! France May CPI prelim Rises +5.1% yoy Only

o Monthly Fall of 0.1% mom is 1.7SDs Below Historic Seasonal Trends

o Inflation Drivers: Food +14.1% yoy

o Inflation Dampers: Energy +2% yoy, Services +3%, Manufactured Products +4.1%

Surprise! France April Domestic PPI Rises +7% yoy Only

o Monthly Fall of 5.1% mom is 3.8SDs Below Historic Seasonal Trends

o Mining/Energy +13.7% yoy

o Manufactured Products +4.1% yoy, with F&BT +14.8%, Transport Equipt +10.4%, Electricals/Electronics +6.2%

o Damper: Coke & Refinery Down 25.2% yoy

Shock! France H’hold Consumer Spending Falls 1% mom and 4.3% yoy

o Food Products Down 1.8% mom, Energy Down 1.9%

o Engineered Products +0.1% mom, with Durables Unchanged, Textiles/Clothing and Other Products +0.1%

Surprise! Italy May CPI prelim Rises +7.6% yoy Only

o Monthly Rise of 0.3% mom is in Line with Historic Seasonal Trends

o Non-Regulated Products +20.5% yoy (vs 26.6% in April

o Processed Food +13.4% (vs 14%), Transport +5.5% (vs 6%)

o Inflation Drivers: Unprocessed Food +8.9% yoy (vs 8.4%), Housing Servs +3.4% (vs 3.2%)

o Core CPI +6.1% yoy (vs 6.2% in April)

Asia (28 tracked)

Shock! China May CFLP Manufacturing PMI Falls 0.4pts to 48.8

o Weakest Since Dec 2022

o New Orders Down 0.5pts to 48.3, with Export Orders Down 0.4pts to 47.2

o Output Down 0.6pts to 49.6, with Backlogs Down 0.7pts to 46.1, and Finished Inventories Down 0.5pts to 48.9

o Expectations Down 0.6pts to 54.1, and Payrolls Down 0.4pts to 48.4

o Input Prices Down 5.6pts to 40.8, Output Prices Down 3.3pts to 41.6

o Output Prices Weakest Since July 2022

Shock! Japan April Industrial Production Falls 0.4% mom and 0.3% yoy

o Consensus is Optimistic, as Monthly Movt Close to Historic Seasonal Trend

o Drags: Production Machinery Down 7.4% mom, Iron& Steel and Non-Ferrous Down 1.1%, Transport Equipt ex-Autos Down 1.2%

o Positive Offsets: General Purpose/Business Machinery +11.6% mom, Electronic Parts & Devices +8.9%, Electrical Machinery & Infocomms Equipt +4.9

Shock! Japan April Retail Sales Value Rises +5.1% yoy Only

o Consensus is Optimistic, as Monthly Movt is Only 0.1SDs Below Trend

o Dept Stores +7.6% yoy, Convenience Stores +5.3%, Supermarkets +4.4%

o Home Electric Appliance Store Down 3.9% yoy, Drugstores +8.8%, CIY Stores +0.4%

Shock! Japan April Housing Starts Drop 11.9% yoy

o Monthly Movt 2.9SDs Below Historic Seasonal Trends

o Houses for Sales Down 21.8% yoy, with Detached Houses Down 0.8%, Multi-Family Down 43%

o Houses for Owner-Occupiers Down 11.6% yoy, for Rent Down 2.8%

Shock! S Korea April Retail Sales Fall 2.3% mom and 1.1% yoy

o Monthly Movt is 1.3SDs Below Historic Seasonal Trends

o Autos Down 1.7% mom, Fuel Down 1%

o Drags: Clothing Down 9% mom, Furniture Down 6.8%, Cosmetics Down 4.5%

o Positive Offsets: Pharma +1.7% mom, H’hold Appliances +0.5%

Shock! Hong Kong April Mortgage Approvals Fall 4.1% yoy

o Monthly Movt is 1.7SDs Below Historic Seasonal Trends

o Capital Lent Down 7.2% yoy, and 1.7SDs Below Trend

o Value: Primary Market +68.7% yoy, Secondary Down 9.1%, Refinancing Down 50.7%

o Outstanding Mortgage Debt +0.2% mom and +3.4% yoy to HK$1.823tr

Surprise! Singapore April Fiscal Cash Balance Shows S$1.8bn Surplus

o Net Inflow from Operating Activities +$2.36bn

o Receipts of $5.95bn, vs Payments of $3.59bn

o Cash Outflow from Investments in Non-Financial Asset $527mn

Shock! Australia April CPI Rises +6.8% yoy

o Monthly Rise of 0.8% mom is 0.8SDs Above Historic Seasonal Trends

o Inflation Drivers: F&B(dry) +8.1% yoy, Housing +9.5%, with Electricity +15.7%

o Inflation Dampers: Transport +0.8% yoy, Comms +1.2%, Clothing & Footwear +3.2%

Surprise! Australia April Private Sector Credit Gains +0.6% mom

o Largest Monthly Rise Since Sept 2022

o Housing +0.3% mom and +7.9% yoy

o Personal Loans +0.1% mom and Down 2.5% yoy

o Business Credit +1.1% mom and +10.7% yoy