Macro Kernel - 19th April

Notable Today

Let us pause for a moment to pay tribute to the British government’s energy policy, which in a feat of marvelous dexterity has managed keep British gas prices rising by 129.4% yoy in March despite the fact that international gas prices are down just over 50% yoy. Stand back and admire: since October, international gas prices have fallen 60.5%; but British retail gas prices are up 0.3%.

It’s dominoes: virtually single-handedly, gas prices have pushed up regulated electricity prices by 66.7% yoy. And so housing and household services rose 26.1% yoy, and total CPI in March rose 10.1% yoy. That’s with a 0.8% mom rise which was 2.8SDs above historic seasonal trends.

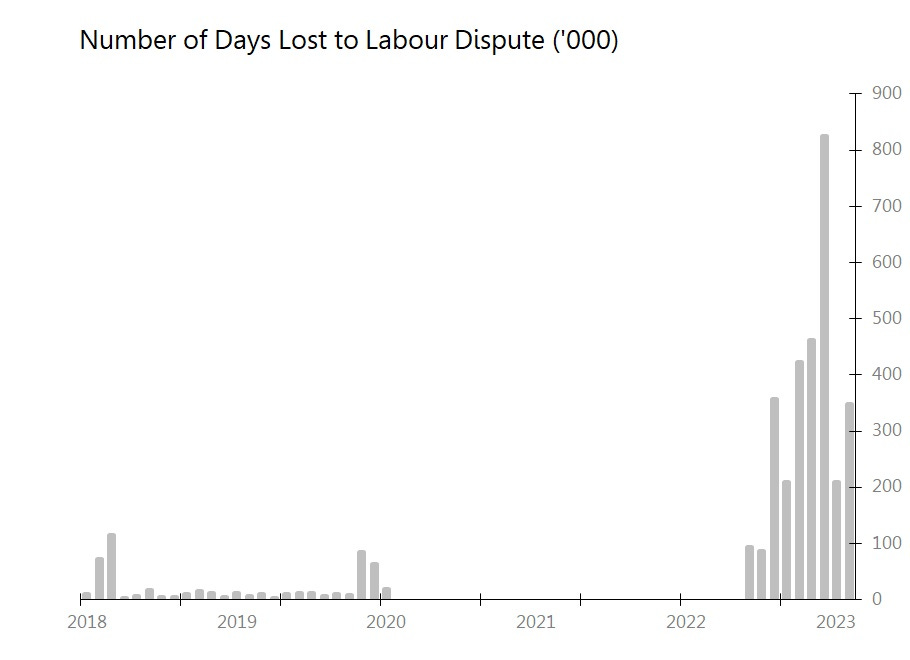

As a way of impoverishing the population and fostering inflation expectations and labour unrest, the energy policy could hardly be improved upon.

Although regulated gas prices will, must, submit to the fall in international prices, there’s good reason to believe now that the damage has been done, to expectations and to margins, and consequently to wage pressures. Before our eyes, Britain’s energy policy is entrenching inflation in a way which is internationally unusual.

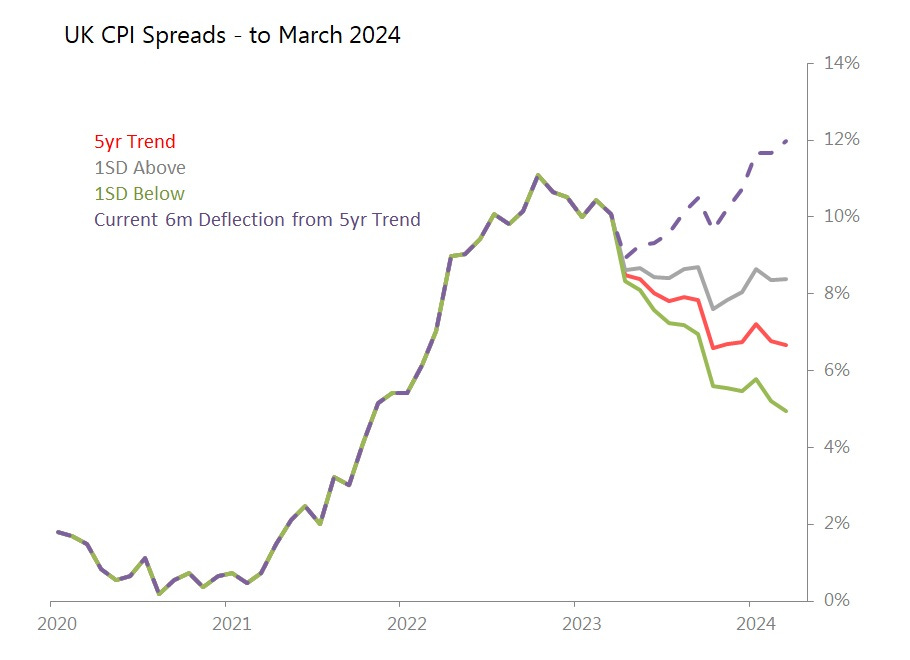

Expectations first: if the breaks above trend seen during the last six months, after some mild relief during the next five months, will find itself back in double-digit inflation in 3Q. I don’t actually believe this will happen, because regulated gas prices must come down. Even so, it’s a stretch to believe inflation will simply retreat to ‘normal’ patterns, and even if it does for the rest of the year, 4Q inflation will still come in at around 6.8%. Even with a break 1SD below trend sustained for the rest of the year, 2023 inflation will come in at 8.2%.

These are the sort of outcomes which are now ‘reasonable’ to expect.

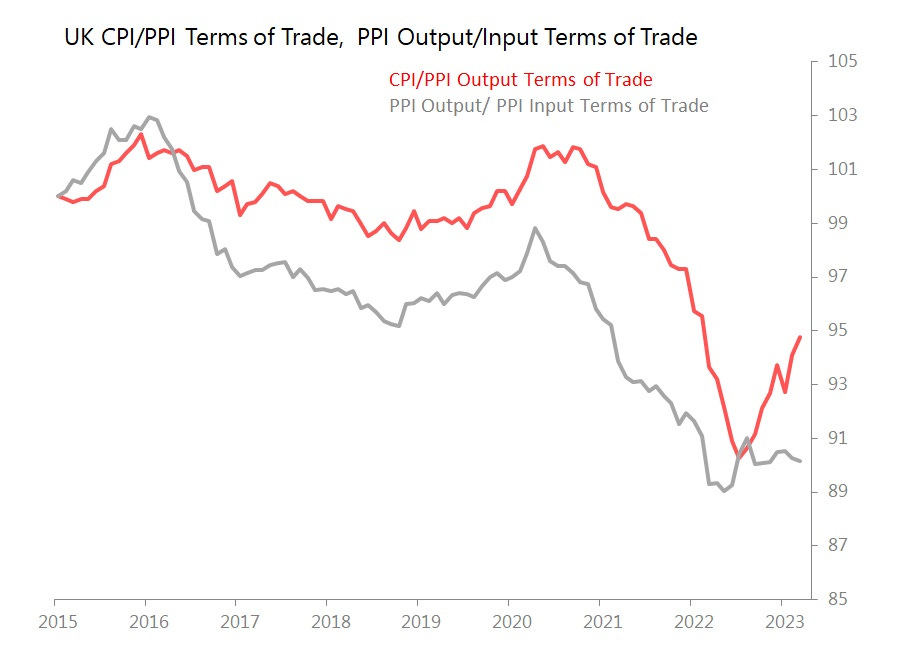

Margins: The second result of the disastrous energy price regime is that CPI / PPI margins have still got a long way to go to recover to pre-covid levels. Unlike in the US, (compare here) this margins recovery work is nowhere near complete. As the chart below shows, there has been effectively no recovery in PPI Output / Input margins, so we can expect further upward pressure on PPI Output prices (which rose 8.7% yoy in March, whilst PPI input prices rose 7.6% yoy), and further upward pressure on CPI prices relative to PPI Output prices. The struggle to recover pricing margins is obvious throughout the entire supply system.

And in turn, that is likely to encouraged sustained labour market pressure, as workers attempt to restore lost purchasing power. At the moment, British strikes are largely confined to the public sector. Which is at least appropriate, given how government policy has generated inflation.

A word of apology: two weeks ago I questioned whether Germany’s very strong February industrial data could be justified, given how it was depending on a very strong recovery in Eurozone-ex-Germany car demand. Well, the data for March is in, and. . . Eurozone ex-Germany new car registrations jumped 38% yoy with a monthly movt 1.7SDs above trend, and the highest number of cars registered in a single month since June 2019.

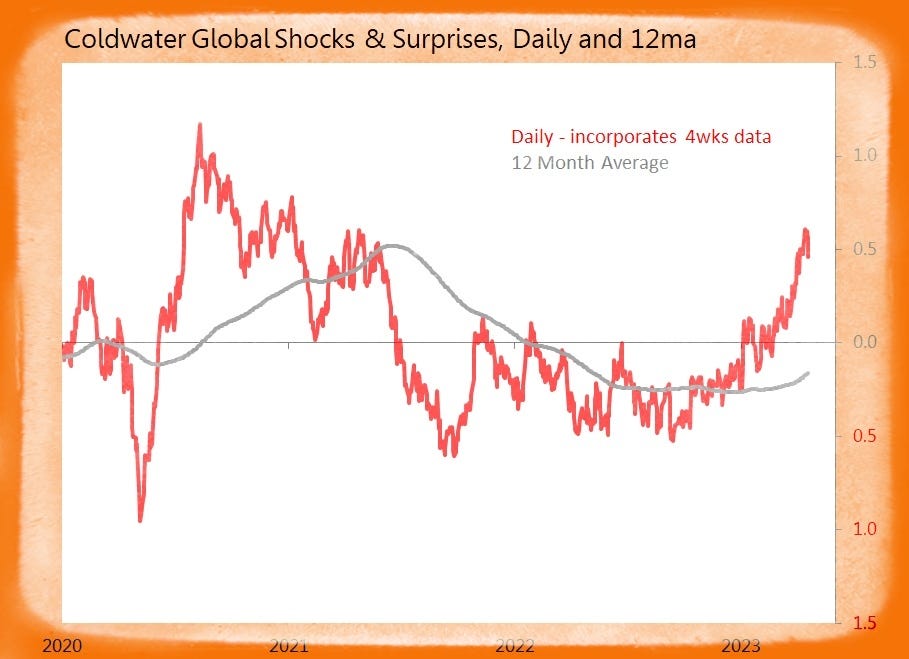

Summary: Only 14 tracked today, but they produced two surprises and three shocks.

US (1 tracked)

Shock! Weekly MBA Mortgage Applications Fall 8.8% wow

o Applications for New Purchase Down 10% wow and Down 36% yoy

o Applications for Refinancing Down 6% wow and Down 56% yoy

o Refis Account for 27.6% of Applications (vs 27% previous week)

o Av 30yr Rates Rise to 6.43% (vs 6.30% previous week)

Europe (12 tracked)

Shock! UK March CPI Rises +10.1% yoy

o Monthly Rise of 0.8% mom is 2.8SDs Above Historic Seasonal Trends

o Goods +12.6% yoy, Services +6.6%

o Govt Regulated Energy Prices at Work! Electricity +66.7% yoy, Gas +129.4%

o Housing & H’hold Services +26.1% yoy, F&B +19.1%, Restaurants & Hotels +11.3%

o Dampers: Transport +0.8% yoy, Education +3.2%, Comms +3.7%

Surprise! EU March New Car Registrations Jump +28.8% yoy

o Monthly Movt 1.6SDs Above Historic Seasonal Trends

o Busiest Monthly Sales Since July 2019

o Eurozone +30.8% yoy, Non-Eurozone +16.9%

o Eurozone: Germany +16.6% yoy, France +24.2%, Italy +40.7%, Spain +66.1%

Surprise! Eurozone ex-Germany March New Car Registrations Jump +38% yoy

o Monthly Movt is 1.7SDs Above Historic Seasonal Trends

o France +24.2% yoy, Italy +40.7%, Spain +66.1%

o Belgium +39.9% yoy, Netherlands +51.1%

Shock! Italy Feb Current Account Balance Reports Eu884mn Deficit

o Good Balance Improves Eu3.396bn yoy to Eu2.271bn Surplus

o Services Deficit Widens Eu459mn yoy to Eu2.169bn

o Net Int’l Income Receipts Fall Eu1.359bn yoy to Eu1.24bn

o Net Current Transfers Out of Italy Rise Eu313mn yoy to Eu2.227bn