Macro Kernel - 5th April

Notable Today

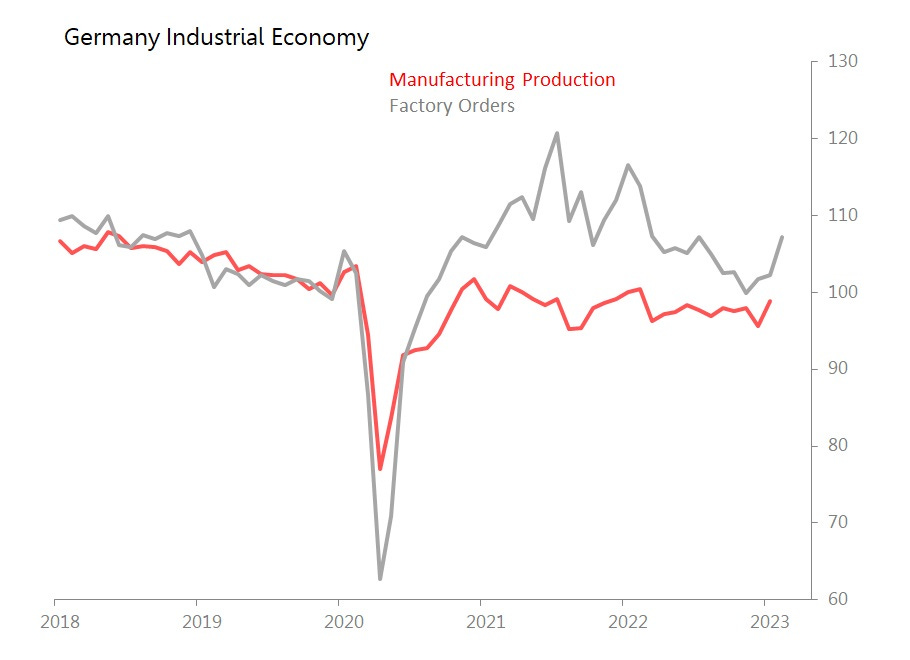

Are Germany’s factory orders recovering quite as quickly as monthly data suggests? February’s orders rose 4.8% mom, with domestic orders up 5.6% and foreign orders up 4.2%, of which the star was the Eurozone +8.9% whilst RoW rose only 1.4%. Drilling down, it’s capital goods orders doing the work, up 7.3% mom, led by a 15.9% gain in Eurozone orders. Getting even further into the weeds, what’s driving capital goods is transport equipt, which rose 11.4% mom, with domestic orders up 20.9%, and Eurozone orders up 26% whilst RoW fell 0.4%.

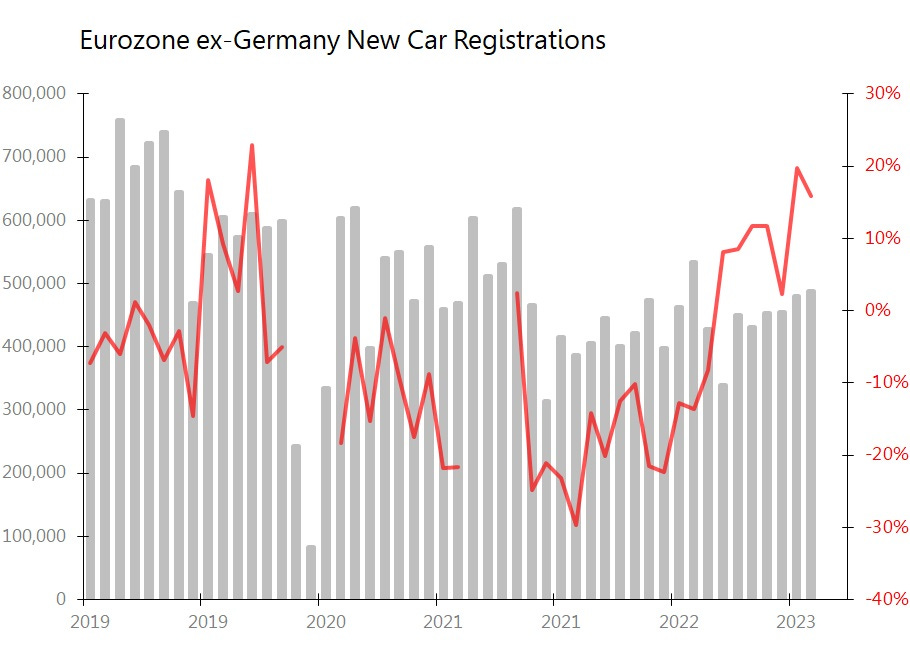

The problem is this: there’s really no sign that demand for vehicles in Eurozone ex-Germany is booming. Rather, there is a mild rebound essentially sustaining the historically depressed levels seen since 2021. In February, registrations were up 15.9% yoy, but this was still 18.5% lower than Feb 2020, and 22.6% below pre-pandemic Feb 2019.

Nor do EU commercial vehicle & heavy truck sales record any surge in demand.

One possible explanation for this discrepancy is that Germany auto manufacturers are stuffing channels elsewhere in the Eurozone in order to keep order books, production and employment numbers stable. If so, very much later in the year, we’ll see the results showing up in unexpected inventory gains in Eurozone ex-Germany, probably at just the time when Germany’s factory orders begin to disappoint.

The US ADP payrolls headline number - up just 145k - was disappointing. What is far more concerning is that new payrolls continue to be concentrated heavily in the lowest-wage, lowest-productivity sector of the economy, ie, leisure & hospitality. In March, total payrolls rose 145k, with leisure & hospitality up 137k. By contrast, look at what’s suffering: professional & business services down 46k, financial dosn 51k, and manufacturing down 30k. Over the last 12 months, ADP’s numbers tell us payrolls have risen 3.01mn, but of those, no fewer than 1.247mn came in leisure & hospitality, with the entire rest of the economy contributing just 1.763mn.

Can you build an economy on baristas alone? Short term, yes; long-term, no.

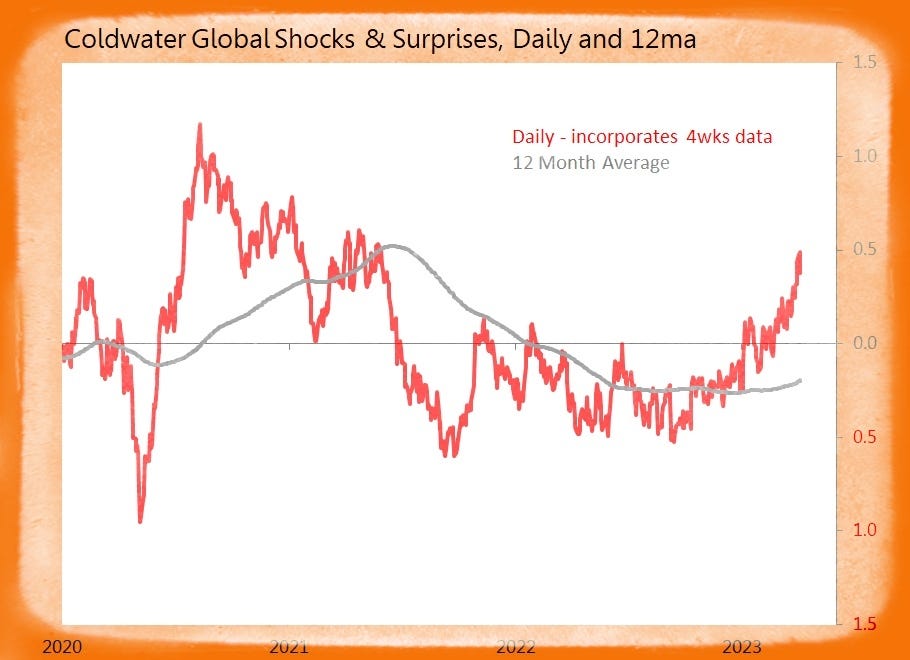

Summary: 23 datapoints tracked today, generating four surprises and only two shocks. The global index continues its modest but sustained recovery.

US (7 tracked)

Shock! March ADP Private Employment Rises +145k Only

o Small Cos +101k, Medium-Sized +33k, Large Cos +10k

o Largest Gains: Leisure & Hospitality +98k, Trade/Transp/Utils 56k, Construction +53k

o Largest Falls: Prof & Business Servs Down 46k, Financial Down 51k, Manufacturing Down 30k

·

Surprise! Feb Exports Surprise Fall 2.7% mom sa Only

o Goods Down 4.8% mom, Services +2.1%

o Goods: Autos Down 11.9% mom, Consumers Down 5.8%, Industrial Supplies Down 4.1%

o Goods: FF&B +0.4%

o Services: Travel +11.1% mom, ‘Other Business Servs’ +0.9%

o Markets: EU Down 9.6% mom, China Down 9.7%, Mexico Down 3.9%, Canada Down 3.4%

o Markets: Japan +5.5% mom

Europe (11 tracked)

Surprise! Germany Feb Factory Orders Jump +4.8% mom, Best Since June 2021

o Domestic Orders +5.6% mom, Foreign +4.2%, o/Eurozone +8.9%, RoW +1.4%

o Capital Goods +7.3% mom, with Domestic 9.9%, Foreign +5.9%, o/w Eurozone +15.9%, RoW +1.2%

o Intermediates +1.3% mom, with Domestic +1.6%, Foreign +0.9%

o Consumers +1.9% mom, with Domestic +1.3%, Foreign +2.2%

o Transport Equipt +11.4% mom, with Domestic +20.9%, Foreign +7.1%, o/w Eurozone +26%, RoW Down 0.4%

Shock! UK March New Car Registrations Rise +18.2% yoy Only

o Very Easy Base of Comparison, with Monthly Movt 0.9SDs Below Trend

o Fleet Sales +40.9% yoy, Business Sales +120.2%, but Private Sales +1.4% Only

o Petrol-Powered +16.5%, Diesel Down 19.8%, Alternatives +23.7%

Surprise! Italy March Markit Services PMI Jumps 4.1pts to 55.7

o Suggests Busiest Activity Since April 2022

o New Orders Best Since Nov 2021, with Export Orders Rising First Time Since July 2022

o Work Backlogs Rise Slightly, First Rise in Just Under a Year

o Positive Sentiment Weakens, but Payrolls Rise Most Since May 2022

o Input Inflation Mildest in 18 months, Output Inflation Lowest in 14 months

Surprise! Spain March Markit Services PMI Gains 2.7pts to 59.4

o Suggests Busiest Activity Since Nov 2021

o New Orders Strongest in 16 months, with Export Orders 4th Strongest on Record

o Backlogs Rise for Third Month

o Positive Sentiment Lowest in 3m, but Payrolls Rise Most Since June

o Input and Output Inflation Still High Despite Easing