Macro Kernel - 31st March

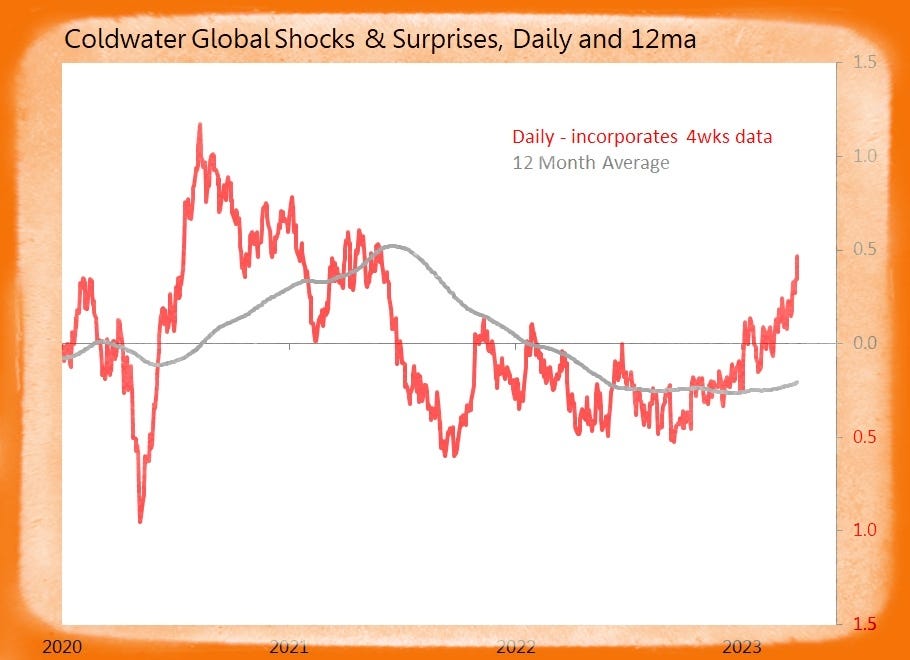

52 datapoints, with 14 surprises and seven shocks

Notable Today

Statisticians in Asia and Europe like to release the majority of their data on the last day of the month, so today we’re looking for the signals in the 46 datapoints they released into the wild, generating 14 surprises and seven shocks. And a severe TLDR problem for this email . . .

First, two general observations. Asia’s positive result (seven surprises vs only two shocks) is being boosted by the calendar impact of Chinese New Year falling in January rather than (as normal) February. This is particularly clear in Hong Kong’s 31/3% yoy jump in retail sales (with watches/jewellery up 128% yoy, and clothes up 104%) and its 35.9% yoy jump in mortgage approvals. But even taking this into account, Hong Kong’s Feb vitality is astonishing - mortgage approvals were 4.1SDs above trend!

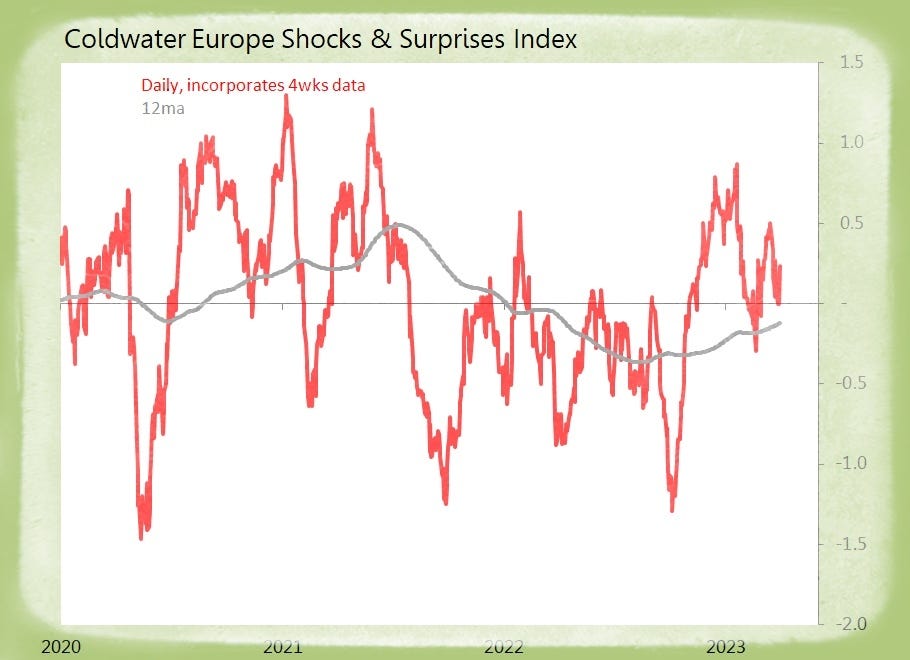

Second, Europe’s result was (seven surprises, five shocks) was the product of two stories; first, the retreat of inflation, seen in Eurozone CPI, Italy CPI, France PPI and Germany import prices, generated most of the surprises, whilst weak end demand signals were responsible for the shocks.

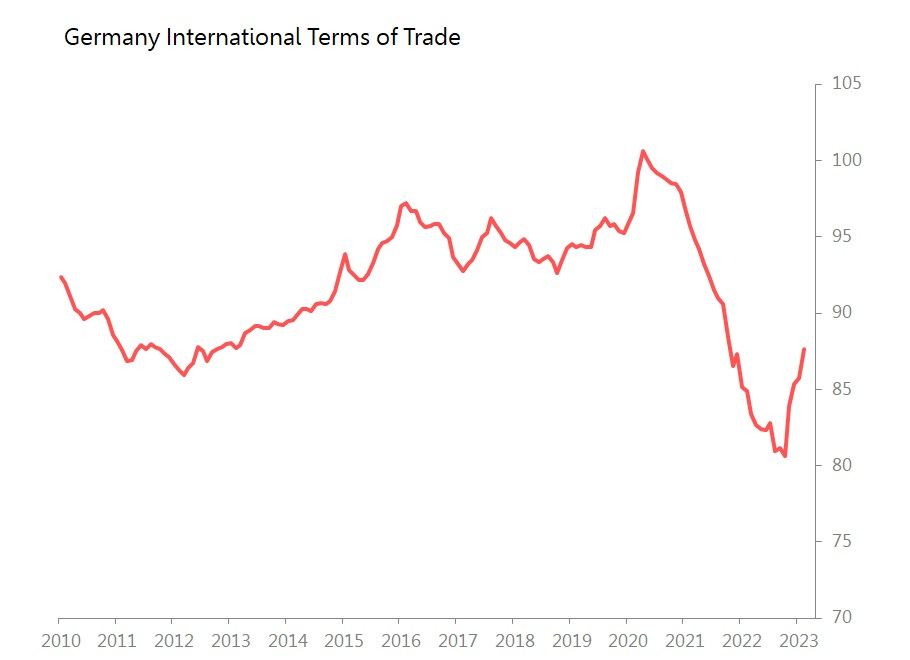

Now for the results I think deserve a little more attention. The first is what’s happening in Germany’s trade prices: in February, import prices fell 2.4% mom and rose only 2.8% yoy, whilst export prices fell only 0.2% mom and rose 6.6%. This means that Germany’s terms of trade gained a further 2.2% mom and were actually up 3.2% yoy. This is becoming quite a significant recovery, returning terms of trade to no worse than they were back in 2011-2012. If this continues, then the lip-smacking conventional wisdom that Germany is being forced into de-industrialization by energy prices is going to be wrong.

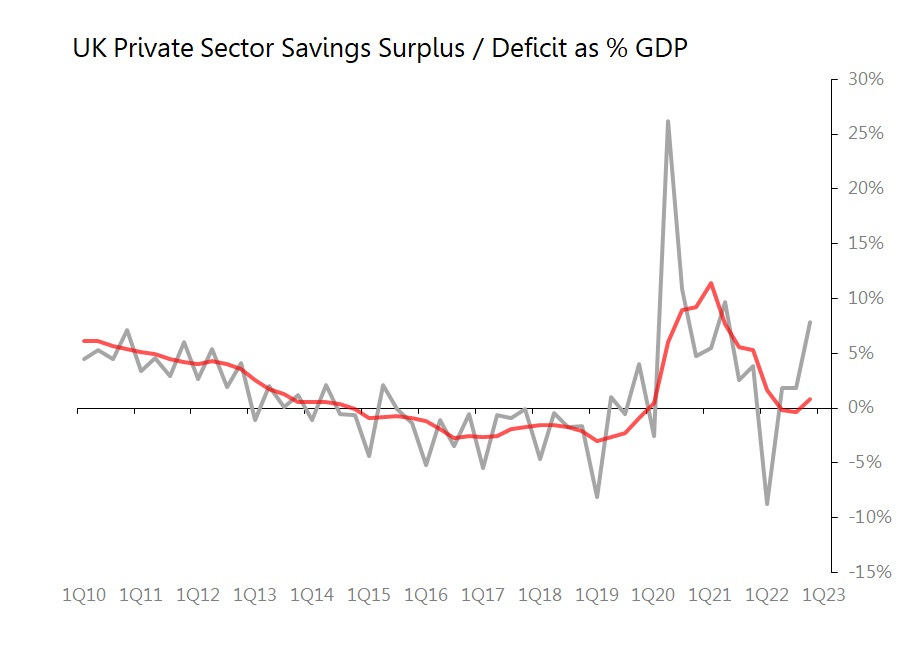

Second, the announcement that the UK’s current account deficit has shriveled to a mere £2.5bn in 4Q (vs £12.7bn in 3Q) was absolutely unexpected. It means that the UK has joined the US and Eurozone in generating a small private sector savings surplus in 2022, equivalent to 0.8% of GDP. I wish this was the end of the story, but it isn’t, because the narrowing of the current account deficit was almost entirely owing to the trade in precious metals - something with very little connection to the UK’s actual economy. Strip out the trade in precious metals and the underlying deficit is little changed at £21.1bn, and the private sector savings surplus is cut to just 0.1% of GDP.

Summary: No less than 52 data releases tracked today, generating 14 surprises and seven shocks. A hefty upward push, then, for the global index.

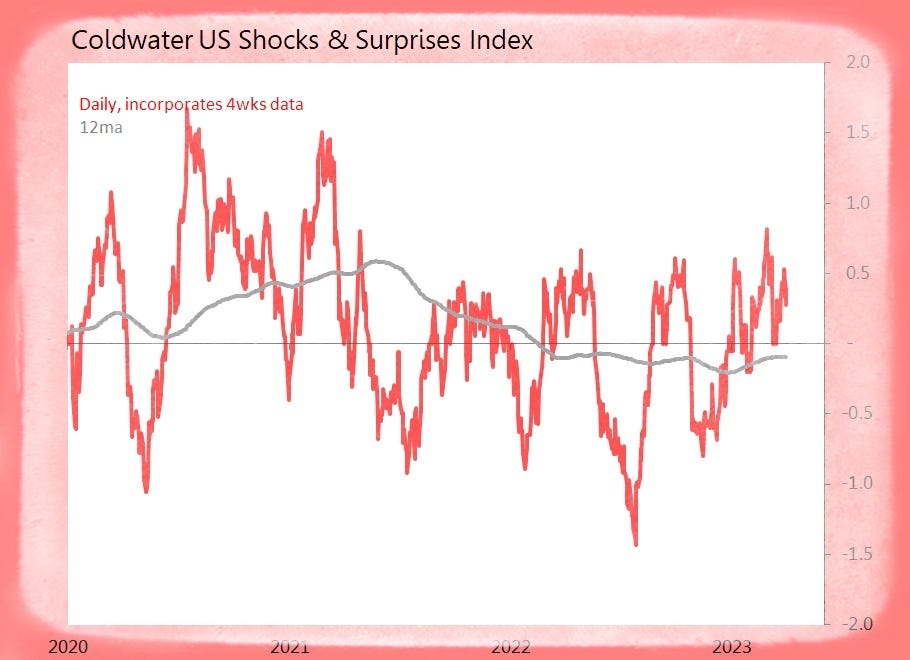

US (6 tracked)

· None – Today’s Data Stays Within Range

Europe (18 tracked)

Surprise! Eurozone March CPI prelim Rises +6.9% yoy Only

o Monthly Rise of 0.9% mom is 1.1SDs Below Historic Seasonal Trends

o Energy Down 2.2% mom and Down 0.9% yoy; Food +1.3% mom and +15.4% yoy

o Core CPI +5.7% yoy, with a 1.3% mom Rise which is 0.2SDs Below Historic Trend

o Non-Energy Products +6.6% yoy, Services +5%

o Germany +7.8% yoy, France +6.6%, Italy +8.2%, Spain +3.1%

Shock! Germany Feb Retail Sales Volume Fall 1.3% mom and Down 7% yoy

o F&BT Down 7.5% yoy, and Non-Food Down 6.8%

o Drags: Furnishings/H’hold Appliances Down 8.9% yoy, ‘Other Retail’ Down 9.7%

o Less Hit: Textiles/Clothing/Shoes Down 0.7% yoy, Pharma/Cosmetics Down 3.1%

o Petrol Stations Down 2.7% yoy, Sales Ex-Petrol Down 7.1%]

o In-Store Sales Down 6.5% yoy, Non-Store Sales Down 9%

Surprise! Germany Feb Import Prices Rise +2.8% yoy Only

o Monthly Fall of 2.4% mom is 1.8SDs Below Historic Seasonal Trends

o Consumer Goods +8.4% yoy, with Non-Durables +8.6%

o Capital Goods +6.2% yoy, Intermediates +2.6%

o Energy Prices Down 8.1% yoy, with Gas Down 11.2% and Crude Down 10.3%

o Import Prices ex-Crude & Minerals Down 2.3% mom and +3.7% yoy

o Export Prides Down 0.2% mom, so Terms of Trade Improve 2.2% mom and 3.2% yoy

Surprise! UK 4Q Current Account Deficit Narrows £10.2bn qoq to £2.5bn Only

o Balance Saved By Trade in Precious Metals

o Ex-Precious Metals, Underlying Deficit Improved Only £5.2bn qoq to £21.1bn

o Goods Deficit of £63.9bn, Services Surplus of £38.5bn]

o Net Int’ Income Receipts of £9.8bn, Current Transfers Out of UK of £5.4bn

Shock! UK March Nationwide House Prices Fall 0.8% mom and 3.1% yoy

o Average Prices is £257,122, Down for 7th Successive Month

o 1Q Average Fell 1% qoq but Rose 4.8% yoy

o Highest 1Q Rises: East Anglia +6.6% yoy, W Midlands +6.1%, North West +6%

o Lowest 1Q Rises: London +4.1% qoq, Outer Met +4.2%, Outer Southeast +4.3%

Shock! France Feb H’hold Consumer Spending Falls 0.8% mom and 4.1% yoy

o Food Products Down 1.2% mom, Engineered Products Down 0.9%, Energy +0.1%

o Durables Inc Transport Equipt Down 1.6% mom, Inc H’hold Durables Down 2%

o Textiles & Clothing Unchanged mom

Shock! France Feb Retail Sales ex-Autos Fall 1.5% mom and 2.3% yoy

o Jan’s Sales Down 1.2% yoy, with F&BT Down 4.5%, H’hold Equipt Down 2.6%, Non-Store Sales Down 3.6%

o Positive Offsets: Infocomms Equipt +5.8% yoy, Cultural/Recreation Goods +3.8%

Surprise! France Jan Index of Services Rises +1.6% mom and +9.8% yoy

o Drivers: H’hold Services +4.6% mom, Arts & Recreation +6.8%

o Transport & Storage +2.4% mom, Prof/Sci/Tech +2.3%

o Drags: Hostelry +0.2% mom, Real Estate +0.3%, Infocomms +0.5%

Surprise! France Feb Domestic PPI Rises +15.7% yoy Only

o Monthly Fall of 0.9% mom is 1.4SDs Below Historic Seasonal Trends

o Mining/Quarrying/Energy +28.8%, Coke & Refinery +23.2%, F&BT +19.8%

o Electricals/Electronics +6.9% yoy Only, Other Manufactures +8.7%

Surprise! Italy March CPI prelim Rises +7.7% yoy Only

o Monthly Fall of 0.3% mom is 1.1SDs Below Historic Seasonal Trends

o Non-Regulated Energy Products +18.9% yoy (vs 40.8% in Feb), Regulated Energy Down 20.4% yoy (vs Minus 16.4%)

o Non-Durables +6.8% yoy, Services +6.3%, Unprocessed Food +9.3%, Recreation Servs +6.3%

Shock! Italy Feb Industrial Sales Fall 1.1% mom and +9.5% yoy Only

o Domestic Sales Down 0.3% mom, Export Sales Down 2.6%

o Consumer Goods Down 0.4% mom, with Durables Down 1.9%, Non-Durables Down 0.1%

o Intermediates Down 0.4% mom, Capital Goods Down 1.5%

o Energy Down 4.4% mom

Surprise! Spain Jan Current Account Records Eu3.27bn Surplus

o Balance Improves Eu6.37bn yoy

o Goods & Servs Improv Eu5.63bn yoy to Eu2.99bn Surplus

o Net Int’l Income & Transfers Improve Eu742mn yoy to Eu283mn Inflow

Asia (28 tracked)

Surprise! China March CFLP Non-Manufacturing PMI Gains 1.9pts to 58.2

o Strongest Since 2016 at Least

o New Orders up 1.5pts to 57.3, Backlogs Down 4.7pts to 45.6, Inventories Down 1.2pts to 47

o Sentiment Down 1.6pts to 63.3, and Payrolls Down 1pt to 49.2

o Input Inflation Down 0.8pts to 50.3, Selling Prices Down 3pts to 47.8

Shock! Japan Feb Unemployment Rate Rises 0.2pps to 2.6% sa

o Male Rate up 0.3pps to 2.9%, Female Rate up 0.1pp to 2.3%

o Unemployed up 100k to 1.74mn, Employment Down 220k to 66.67m, Labour Force Down 140k

Shock! Japan Feb Job-to-Applicant Ratio Dips 0.1pt to 1.34x

o Applications up 1.6% mom, Job Openings +0.8%

o New Job / New Applicant Ratio Falls 0.06pts to 2.32x

o New Applications +2% mom, but New Job Openings Down 0.4%

Surprise! S Korea Feb Manufacturing Output Falls Surprises 5.1% yoy Only

o Monthly Movt is 1.8SDs Above Historic Seasonal Trends Fully Reverses Jan’s 1.4SDs Shocker

o Output Down 3.1% mom sa, Shipments +1.5%, Inventories +0.9%

o Inventory Turnover Rate Falls 0.6% mom

Surprise! S Korea Feb Retail Sales Index Gains +5.3% mom but Falls 0.8% yoy

o Autos +10.8% mom, Sales ex-Autos +4.8%

o Drivers: Food +13% mom, Telecoms/Computers +11.5%, Clothing +8%

o Drags: H’hold Appliances Down 10.2% mom, Pharma Down 3.6%, Fuel +1.4% Only

Surprise! Hong Kong Feb Residential Mortgage Approvals Jump +35.9% yoy

o Monthly Movt 4.1SDs Above Historic Seasonal Trends – Helped by CNY

o Value Lent +29.8% yoy to HK$34.185bn

o Primary Market Value +71.9% yoy, Secondary Market +45%, Refinancings Down 30%

o Mortgage Debt Outstanding up 3.6% yoy to HK$1.817tr

Surprise! Hong Kong Feb Retail Sales Value Jumps +31.3% yoy

o Monthly Movt is 1.2SDs Above Historic Seasonal Trends

o Watches & Jewellery +128% yoy and 5SDs Above Trend

o Sales ex-Watches & Jewellery +22.1% and 0.7SDs Above Trend

o Drivers; Clothing & Footwear +104% yoy, Autos +1.1%, Optical +10.4%

o Drags: Supermarkets Down 19.9% yoy, with Food +1.7% Only

Surprise! Singapore Feb Money M2 Rises +1.1% mom

o M1 Down 1% mom, with Currency Down 1.2%, Demond Deposits Down 0.9%

o Quasi-Money +2.1% mom, with Fixed Deposits +5.7% but Savings Deposits Down 2%

Surprise! Thailand Feb Current Account Records US$1.33bn Surplus

o Trade Balance Deteriorates $1.32bn yoy to $1.31bn Surplus

o Net Services, Int’l Income and Transfers Improve $3.6bn yoy to $21mn Surplus