Macro Kernel - 29th March

Despite M4 falling, UK monetary conditions remain uniquely accommodating

Notable Today

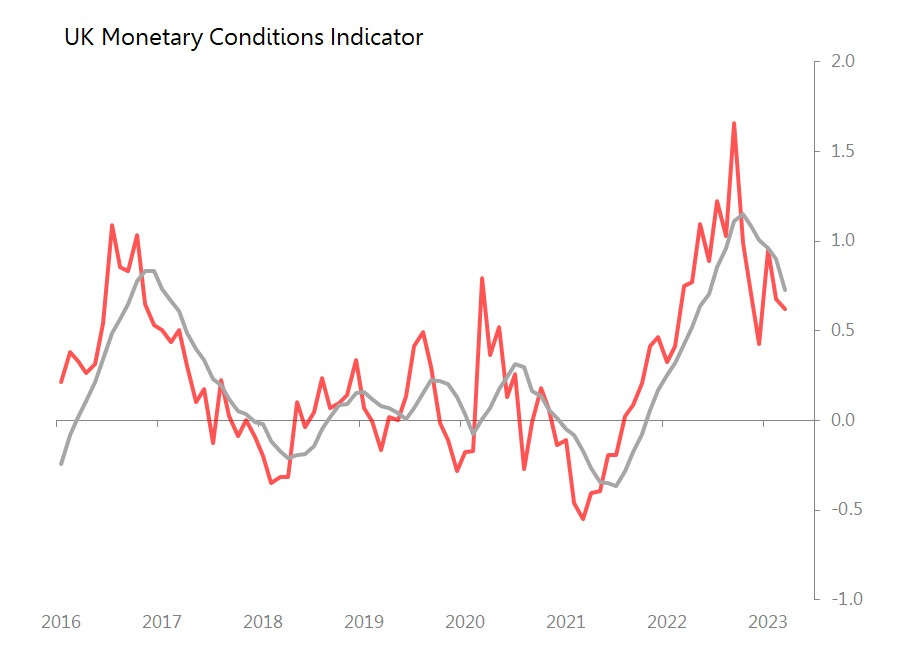

Although on the UK money M4 fell a further 0.2% mom in February, the fifth contraction in the last six months, sharply negative real interest rates are keeping UK’s overall monetary conditions very accommodating.

(My Monetary Conditions Indicator equally weights SD deflections from trend in monetary growth, real bond yields and yield curve, and fx. Whilst growth of monetary aggregates depress this index, this is counteracted by very negative real interest rates and the weakness of sterling.)

In fact, at +0.62 the UK’s MCI is an outlier, with US’s Feb result at minus 0.44, Eurozone minus 1.1, Japan zero, and China +0.42.

The UK is also a global inflation outlier, with February coming in at 10.4%, compared with the Eurozone at 8.5% and the US at 6%, Japan at 3.1% and China at 1% only. Might these two outliers be linked? Ie, might the UK’s uniquely accommodating monetary conditions have something to do with its uniquely stubborn inflation problem?

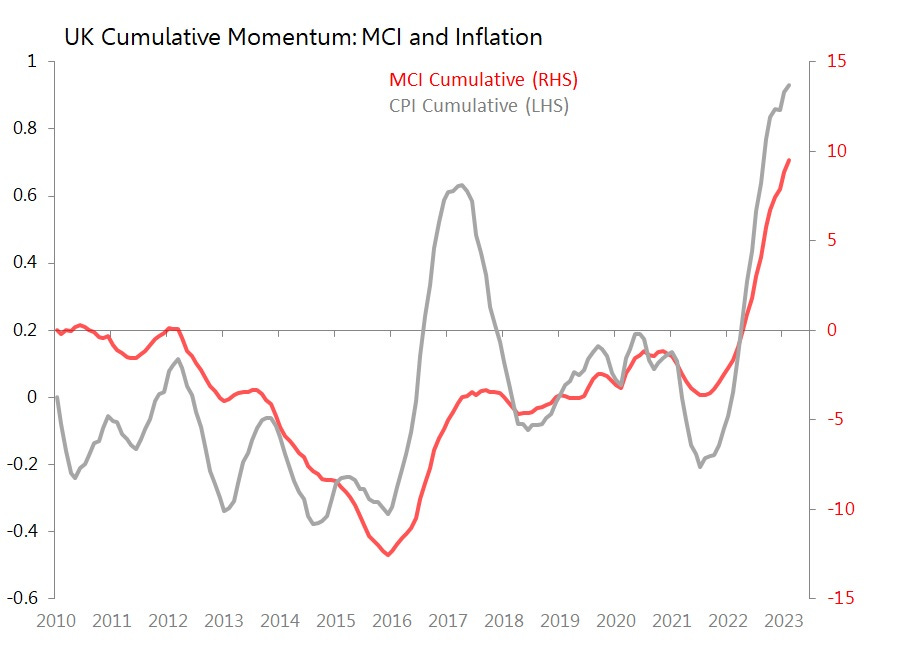

I am generally hostile to simplistic ‘money and only money’ explanations for inflation. However, it seems plausible that over time, accumulated deflections from trend in monetary conditions might show up in accumulated deflections from trend in inflation. This is perhaps the softest and most general interpretation of the ‘money and only money’ inflation explanations. But it might have something in it. Below are the accumulated monthly SD deflections from trend in both monetary conditions and CPI since 2010.

It fits too well, doesn’t it? Isn’t there a danger I’m pretending that a pretty picture with high correlation explains everything. Yes, the danger signs are flashing - we’ve got two different axes displaying two obscurely ‘processed’ signals, and the person who generated it (me) is obviously pleased to have found the ‘correct’ answer.

There’s also autocorrelation at work, since elements of the monetary conditions indicator, such as the real bond yield, is generated in part by the inflation rate itself.

But when it comes to inflation, ‘autocorrelation’ is surely justified: one man’s ‘autocorrelation’ is another man’s ‘feedback mechanism’. And when it comes to inflation, it is precisely those feedbacks which matter - what else are ‘inflationary expectations?’, and are we really to believe that movements in ‘real interest rates’ don’t matter? Are we to believe that exchange rates aren’t influenced by relative inflation rates? In fact, the autocorrelation needs to be there in the picture.

There’s an easy conclusion here: Bank of England has a lot of work to do to tame inflation, and little reason to be expecting the rapid slowdown that its forecasters have pencilled in for the rest of the year.

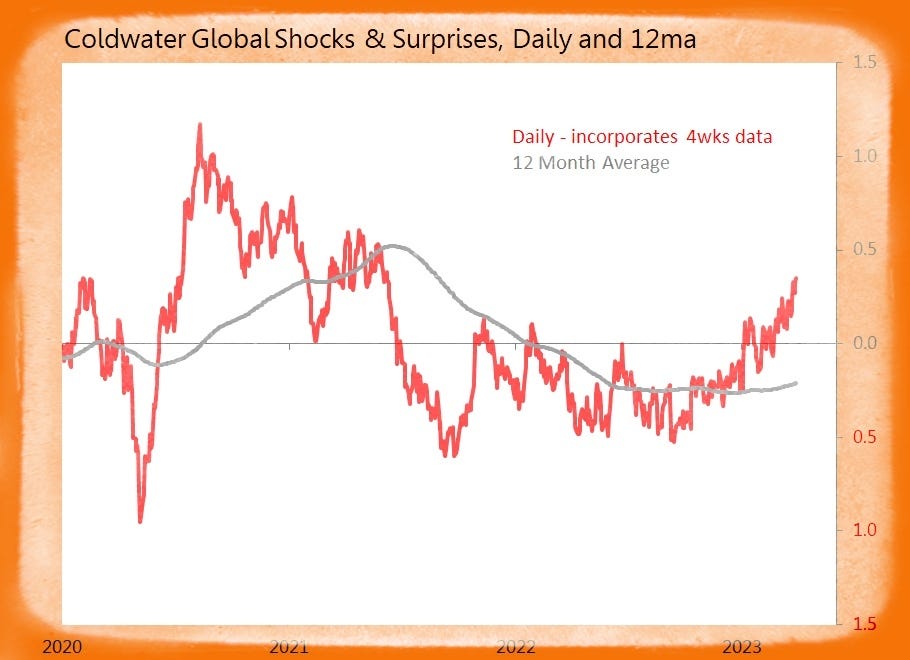

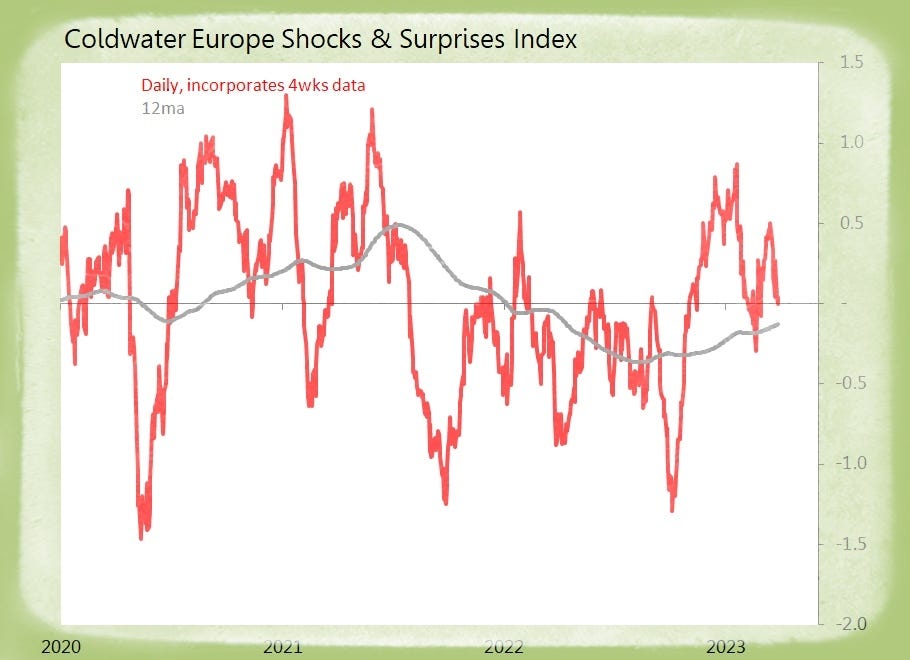

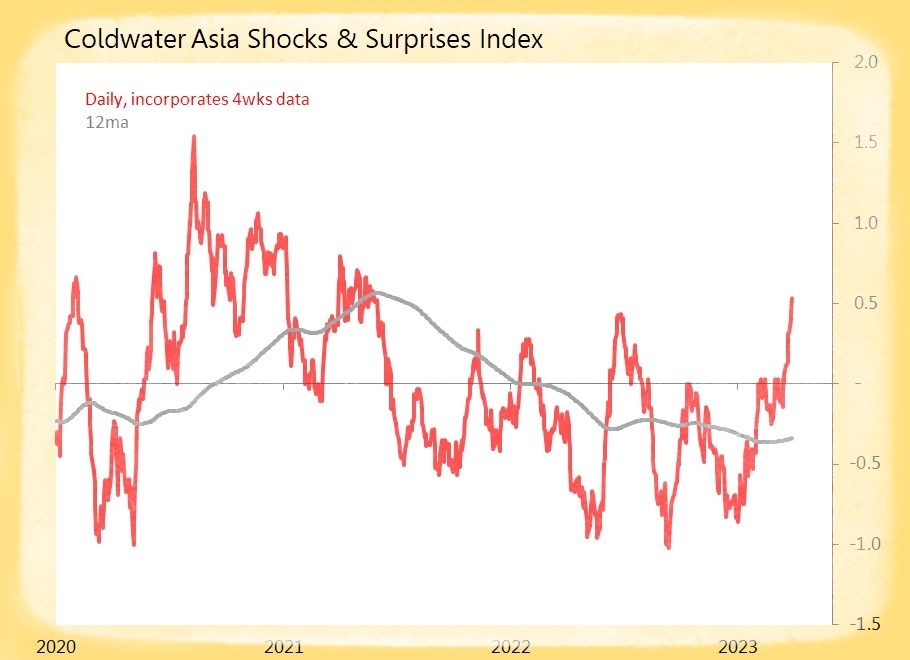

Summary: Another quiet day, with a mere 10 datapoints arriving, generating only two surprises and a single shock. No change in the 12m direction.

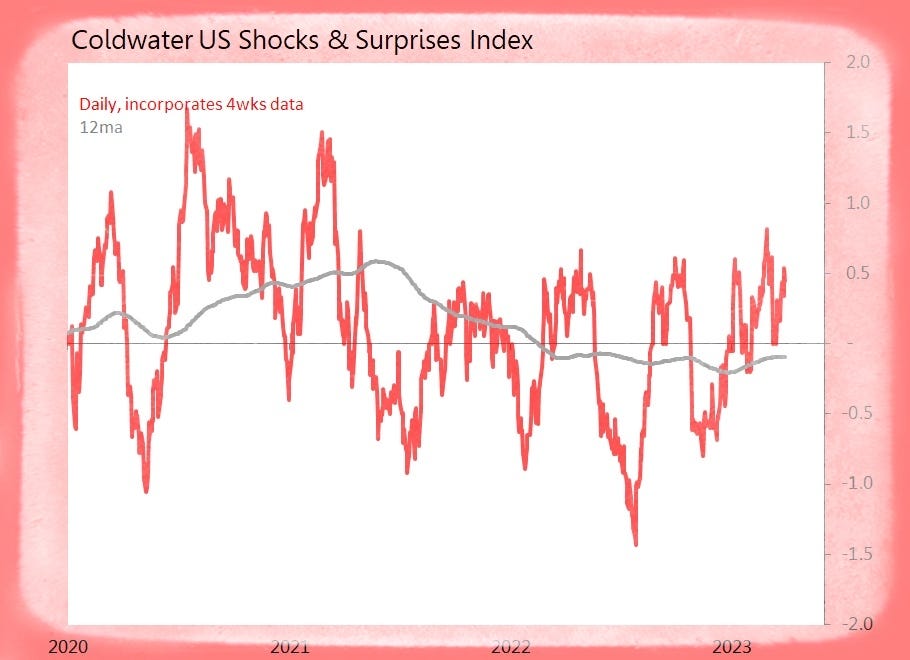

US (2 tracked)

· None – Today’s Data Stays Within Range

Europe (5 tracked)

Shock! UK Feb Money M4 Contracts 0.2% mom and +3% yoy Only

o H’hold Holdings +0.1% mom, but Private Corps Down 0.2%, Non-Monetary Fincos Down 1.6%

o M4 Credit Down 0.9% mom and Down 0.2% yoy

o Credit to H’holds +0.1% mom, Private Corps Down 1%, Non-Monetary Fincos Down 7.9%

Surprise! UK Feb BOE Mortgage Approvals Jump 9.8% mom, Down 38.1% yoy, to 43.5k

o Amount Lent +12.7% mom to £9.69bn

o Av Mortgage up 2.7% and Down 5.5% yoy to £222,643

o Refinancing Approvals +10.8% mom, Amount Refinanced +13.2%

o Total Mortgage Debt Unchanged mom and +3.5% yoy at £1.628tr

Asia (3 tracked)

Surprise! Australia Feb CPI +6.8% yoy Only

o Monthly Rise of 0.2% mom is 0.5SDs Below Historic Seasonal Trends

o Inflation Drivers: Housing +9.9%, with New Houses +13%, Electricity +17.2%; Food +8%

o Inflation Dampers: Comms +1.2% yoy, Clothing/Footwear +3.7%