Macro Kernel - 27th March

Notable Today

No doubt about the main event today: money and credit data for the Eurozone’s February were ghastly: M3 rose only 2.9% yoy, with a 0.1% mom contraction which was 1.5SDs below historic seasonal trends. M2 was up only 2% yoy and was 2.2SDs below trend; M1 fell 2.7% yoy and was 3SDs below trend. Total credit growth slowed to 2.6% yoy and was down 0.2% mom, with credit to the private sector rising only 3.3% yoy on the back of a 0.1% mom contraction. This was before banking problems erupted in the US and Switzerland, and before they were acknowledged in the Eurozone.

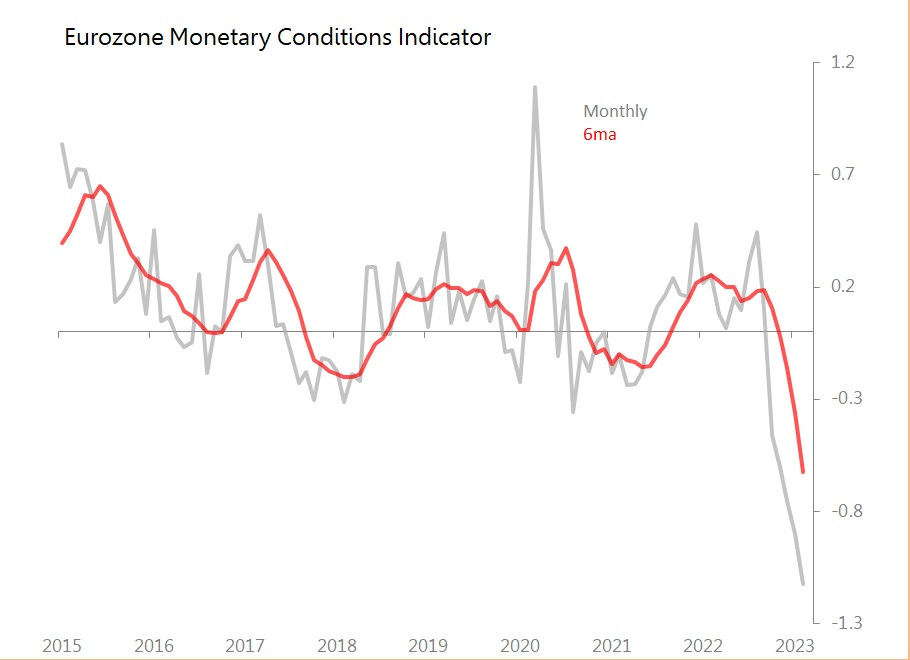

This more than confirmed my worst fears, plunging the monetary conditions indicator for the Eurozone into the deepest part of the red spectrum since 2008. As previously noted, there’s no history of the Eurozone living safely with an inverted yield curve. (PS. this monetary conditions indicator takes into account monetary aggregates, real bond yields, yield curve and fx movements. It is not t6he sort of ‘financial conditions index’ which includes direct financial indicators).

Given the stress revealed in the Eurozone’s banking system, one can certainly expect credit conditions to tighten further in the coming months - it seems as inevitable in Europe as it does in the US.

All the more baffling, then, that Germany’s Ifo survey recorded surprising improvements in the business climate, led by the most buoyant expectations recorded since February 2022.

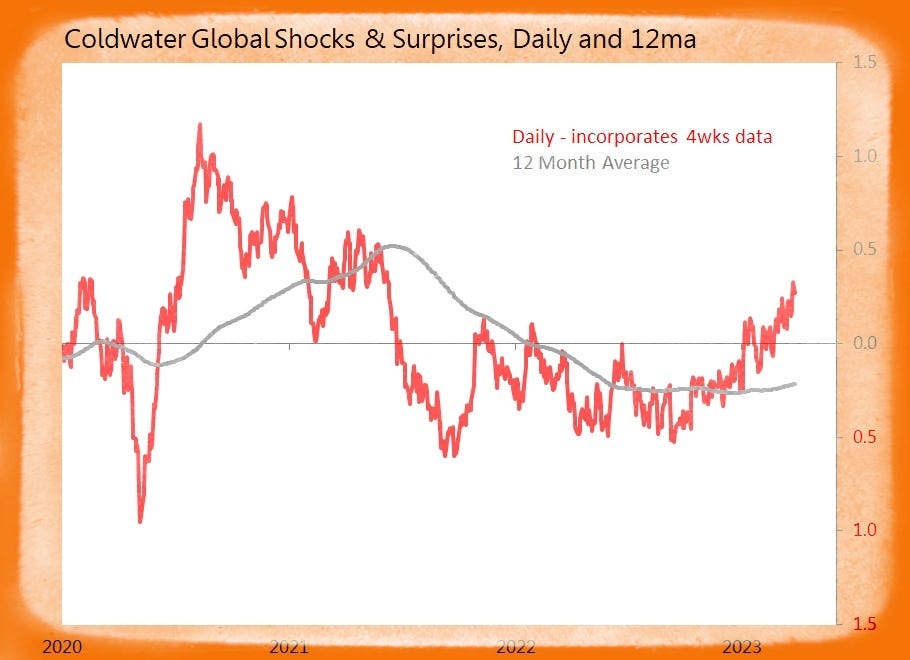

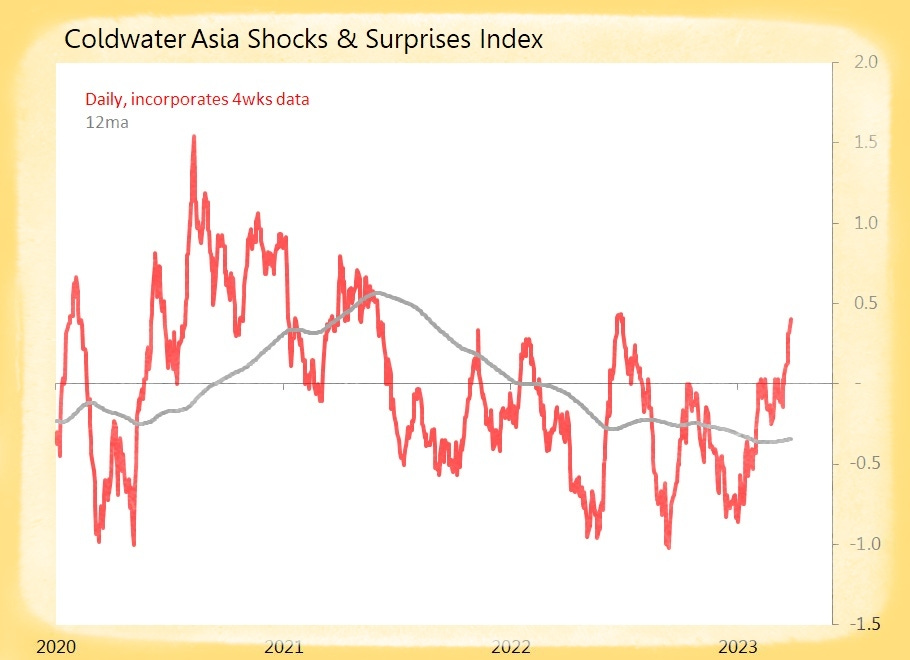

Summary: 17 datapoints tracked today, generating five surprises and five shocks. The global index is steady, and climbing.

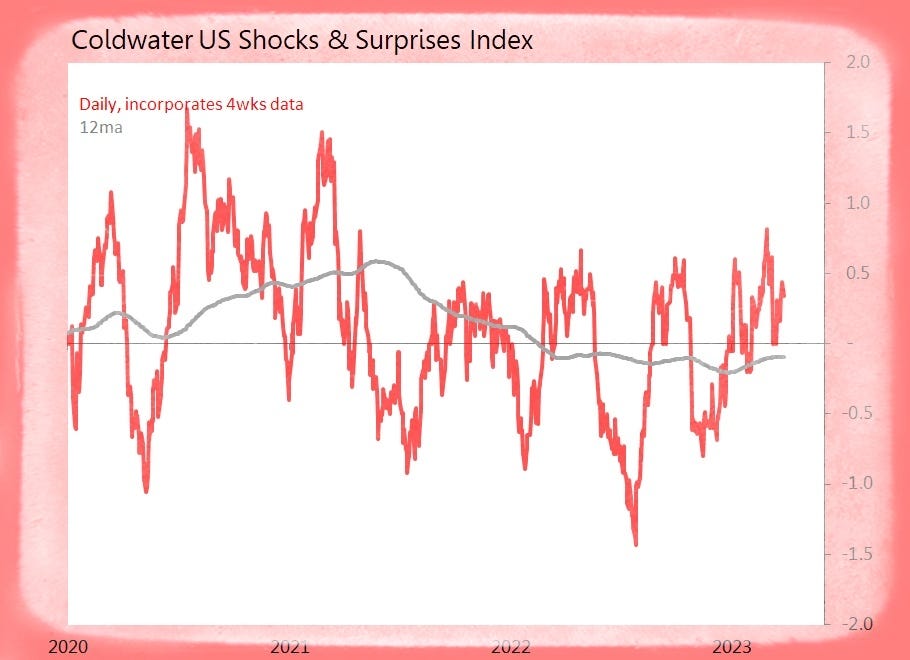

US (1 tracked)

Shock! March Dallas Fed Manufacturing Index Falls 2.2pts to Minus 15.7

o New Orders Down 1.1pt to Minus 14.3, but Production up 5.3pts to 2.5

o Shipments Down 5.5pts to Minus 10.5, with Backlogs up 3.9pts to Minus 9.4, Finished Inventories up 9.6pts to 6.6

o Payrolls up 11.4pts to 10.4, with Hours Worked Down 2.3pts to 2.6, Wages Down 2.2pts to 30.5

o Company Outlook up 4.2pts to Minus 13.3, and Capex up 4.2pts to 2.9

o Prices Paid Down 4.8pts to 20.3, Prices Received Down 8.8pts to 7

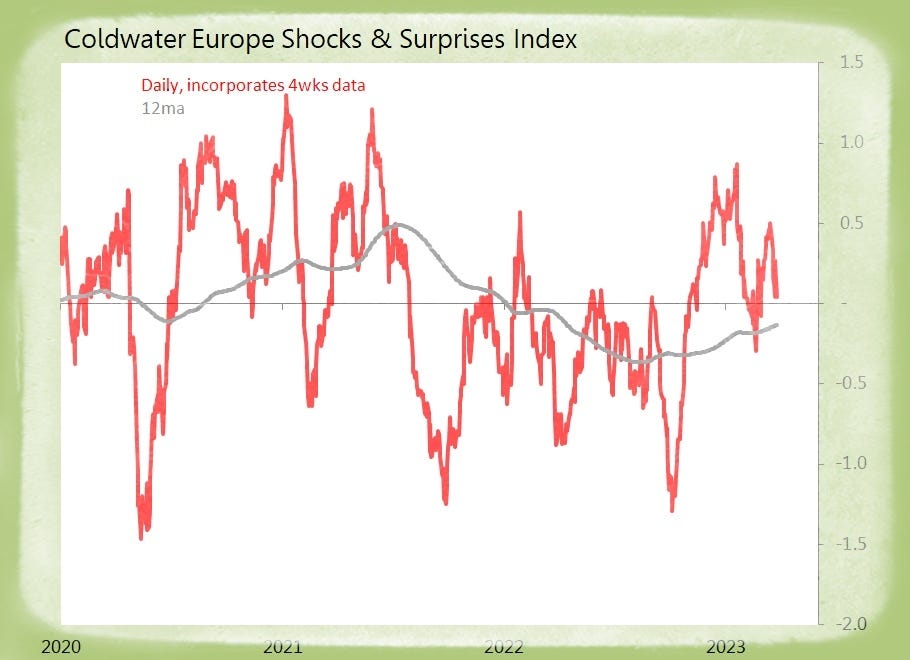

Europe (8 tracked)

Shock! Eurozone Feb Money M3 Gains +2.9% yoy Only

o Monthly Fall of 0.1% mom is 1.5SDs Below Historic Seasonal Trends

o M2 +2% yoy and 2.2SDs Below Trend; M1 Down 2.7% yoy and 3SDs Below Trend

o Credit Growth Slows to 2.6% yoy, with Govt +0.7% and Private Sector +3.3%

o Deposits +1.9% yoy, with H’holds +2.6%, Corporate +2.6%, Non-Monetary Fincos Down 5%, Govt +4.7%

Shock! Eurozone Feb Credit Growth Rises +2.6% yoy Only

o Credit Contracts 0.2% mom

o Credit to Govt +0.7% yoy, with Loans Down 0.8%, Bonds +1%

o Credit to Private Sector +3.3% yoy, with Loans +3.9%, Bonds +0.3%

Shock! Eurozone Feb Credit to Private Sector Rises +3.3% yoy Only

o Credit Contracts 0.1% mom

o Loans +3.9% yoy, and Bonds +0.3%

o Loans to H’holds +3.2% yoy, with Mortgages +3.7%, Consumer Lending +2.9%

o Loans to Corporates +4.9% yoy, with S/T Loans +5%

o Loans to Non-Monetary Fincos +6.1%, Insurance/Pension Funds Down 11%

Surprise! Germany March Ifo Survey Business Climate Gains 2.1pts to 93.3

o Best Since Feb 2022

o Current Situation up 1.5pts to 95.4, Expectations up 2.8pts to 91.2

o DI for Germany up 4.6pts to 3.8

o Manufacturing up 5.12pts to 6.6, Services up 7.6pts to 8.9

o Wholesale/Retail up 0.6pts, Construction up 1.1pts

Surprise! Germany March Ifo Current Assessment Rises 1.5pts to 95.4

o Best Since August 2022

o Manufacturing Noticeably More Satisfied, & Services Significantly Better

o Wholesale/Retail Slightly Better, Construction Somewhat Worse

Surprise! Germany March Ifo Expectations Jumps 2.8pts to 91.2

o Best Since Feb 2022

o Pessimism Almost Gone in Manufacturing, partic Autos, Computer, Electrical & Mechanical Engineering

o Expectations in Services Best Since Feb 2022

o Wholesale/Retail and Construction Rise Slightly

Asia (8 tracked)

Shock! Japan Feb Services PPI More Inflationary Than Expected at +1.8% yoy

o Consensus was Optimistic, as Monthly Rise of 0.2% mom is 0.2SDs above Historic Seaosnal Trends

o Rising Prices: Hotels +30.1% yoy, Int’l Air Passenger +24%, Advertising +3.8%, Leasing & Rental +3.8%

o Falling Price: Infocomms Down 0.2% yoy

Surprise! Hong Kong Feb Exports Fall 8.8% yoy Only

o CNY Impact – Monthly Movt is 4.1SDs Above Historic Seasonal Trends

o Exports to China Down 12.7% yoy, Accounting for 56.2% of Total

o Exports ex-China Down 3.7% yoy, with S Korea +30%, US Minus 1.2%, but Japan Down 23.1% and Taiwan Down 15.9%

Surprise! Hong Kong Feb Imports Fall 4.1% yoy Only

o CNY Impact – Monthly Movt is 4.3SDs Above Historic Seasonal Trends

o Imports from China +6.7% yoy, Accounting for 41.5% of Total

o Imports ex-China Down 10.6% yoy, with US +2.7% yoy, but S Korea Down 49.1%, Singapore Down 34%, Taiwan down 30.1%