Macro Kernel - 27th April

Notable Today

The US 1Q GDP result can honestly be said to be ‘mixed’ - a verdict which will satisfy none of the US’s politically-committed commentariat. But ‘mixed’ is still the right word.

Good News: Private consumption still robust at 3.7% annualized, supported by govt spending at 4.7%.

Good News: Once you strip out the impact of inventory changed, final sales of domestic product rose a healthy 3.9%.

Good News: 12m Kalecki profits up 8.2% qoq and 10% yoy. Yes, really: full accounting in separate piece later today.

Bad News: Fixed capital spending down 0.4% annualized, with non-residential up 0.7% only, and residential down 4.2%.

Bad News: GDP deflator rose to 4% (vs 3.9% in 4Q), with personal consumption deflator rising to 4.2% (vs 3.7% in 4Q).

Bad News: Nominal worker compensation up just 1.5% qoq (vs 1.6% in 4Q), annualizing to 6.1% (vs 6.5% in 4Q)

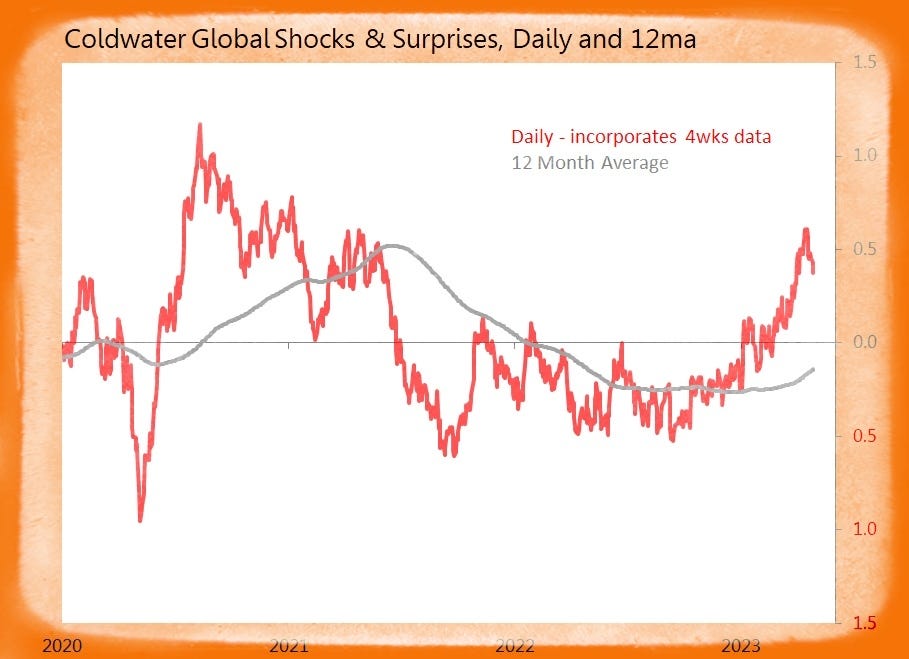

Summary: 22 data releases tracked today, with six surprises and five shocks.

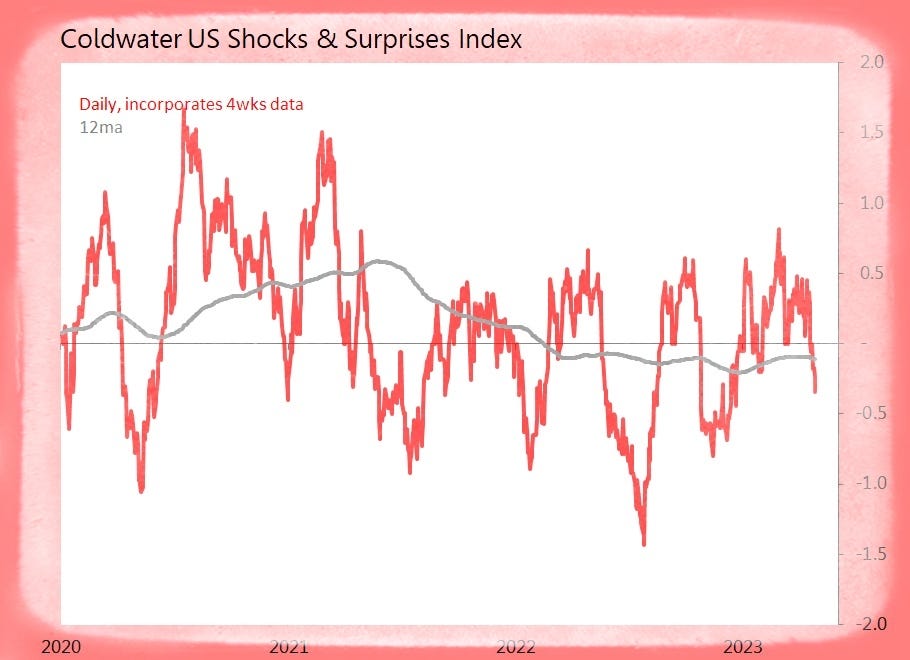

US (5 tracked)

Shock! 1Q GDP 1st estimate Rises 1.1% Annualized Only

o Private Consumption +3.7%, Govt Spending +4.7%

o Private Investment Down 0.4%, with Non-Residential +0.7%, Residential Down 4.2%

o Exports +4.8%, Imports +2.9%, with Net Exports Adding 1.1pps to GDP

o Private Inventories Change Strip 2.26pps to Growth

o Final Sales of Domestic Product +3.9%

o GDP Deflator 4% (vs 3.9% in 4Q), with Personal Consumption Deflator 4.2% (vs 3.7%)

Shock! March Pending Home Sales Drop 5.2% mom and Down 23.3% yoy

o South +0.2% mom and Down 19.8% yoy

o West Down 8% mom, Midwest Down 10.7%, Northeast Down 8.1%

Surprise! Weekly Continuing Jobless Claims Dip 3k to 1.858mn

o California is 24.6% of Total, New York 9.4% & New Jersey 5.6%; Texas 7.1%

o Insured Jobless Rate Unchanged at 1.3%, with California 2.4%, New Jersey 2.4%, Massachusetts 2.1%

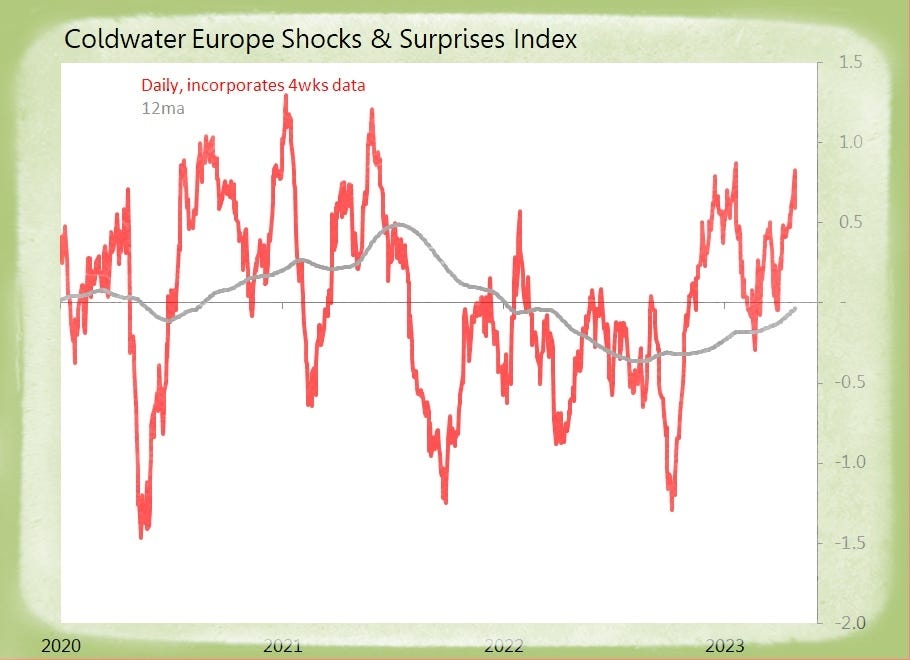

Europe (9 tracked)

Shock! Eurozone April Industrial Confidence Falls 2.1pts to Minus 2.6

o Most Negative Since Jan 2021

o O’all Order Books, Export Orders Fall; Finished Inventories Seen as Too High

o Standout Shock: France Down 5.9pts to Minus 10.4, Worst Since Dec 2020

o Germany Down 1.2pts to Minus 1.3, Italy Down 1.1pts to Minus 1.8, but Spain up 1.8pts to Minus 1.4

Shock! Italy April Manufacturing Confidence Falls 1.1pts to 103

o O’all Economic Sentiment up 0.4pts to 11.5

o Construction up 5.1pts to 164.2, Services up 1.6pts to 105.5, Retail Down 2.7pts to 113

Surprise! Spain March Retail Sales Volume Jumps +9.7% yoy

o Monthly Movt is 2.4Sds Above Historic Seasonal Trends

o Services Station Sales +17.5%, Others +9.1%

o Food Down 2% yoy, but Non-Food +23.1%

o Personal Equipt +28.3%, H’hold Equipt +0.3%, Other Goods +18.1%

Shock! Spain 1Q Unemployment Rate Rises 0.4pps qoq to 13.3%

o Male Rate up 25bps to 11.6%, Female Rate up 52bps to 15.1%

o Employment Down 11.1k, Unemployment up 103.8, Inactivity up 44.9k

o Demographics: Aged 40-44 Down 55.6k, 25-39 Down 20.6k, 16-19 Down 16k

o Job Gains: Aged 55+ up 40.5k, 50-54 up 25.7k

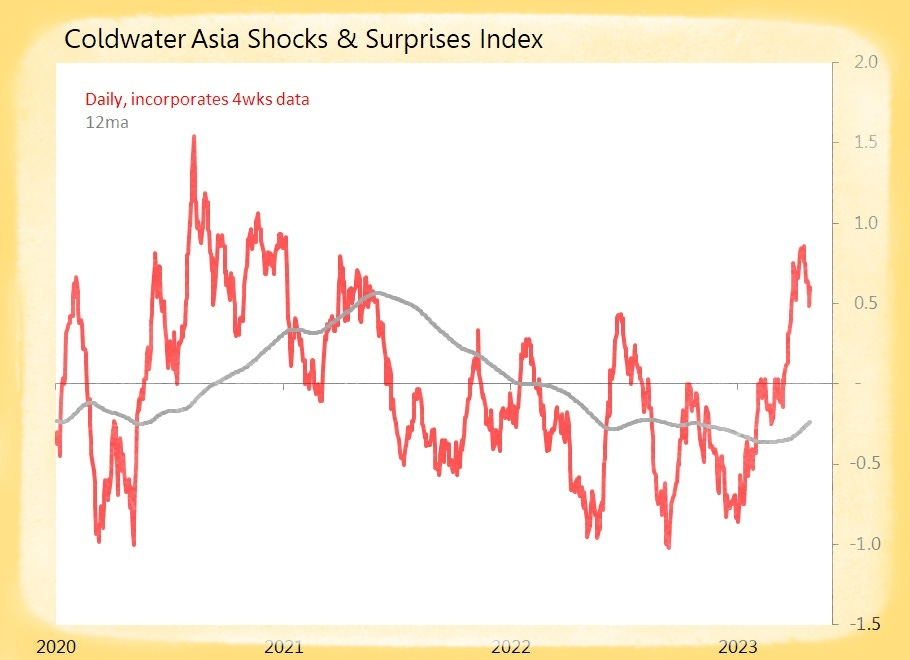

Asia (8 tracked)

Surprise! S Korea April Economic Sentiment Index Gains 2.3pts to 93.8

o Strongest Since Oct 2022

o BOK Manufacturing up 3pts to 69, Non-Manufacturing up 1pt to 73

o Consumer Confidence up 3l1pts to 95.1, Best Since June 2022

o Cyclical Component Falls 0.8pts to 90.1, Lowest Since Nov 2020

Surprise! Australia 1Q Export Prices Rise +1.6% qoq and +6.9% yoy

o Drivers: Metal Ores +16.9% qoq, Crude Fertilizers & Minerals +23.9%, Gold +4.9%

o Drags: Gas Down 15.2% qoq, Coal & Coke Down 5.6%, Meat Down 16.7%

o Import Prices Down 4.2% qoq, so Terms of Trade Improve 5.8% qoq and +1.8% yoy

Surprise! Australia 1Q Import Prices Fall 4.2% qoq and +4.7% yoy

o Price Falls: Petroleum & Products Down 16.6% qoq, Fertilizer Down 36%, Electrical Machinery Down 4.7%

o Price Rises: Specialized Machinery +5.2% qoq, Vehicles +1.5%

Surprise! Japan Feb Leading Index Revised up to 98

o Drivers: Inventory Ratio for Intermediates, Machinery Orders, SME Sales F’casts

o Drags: Housing Starts, New Job Offers