Macro Kernel - 26th May

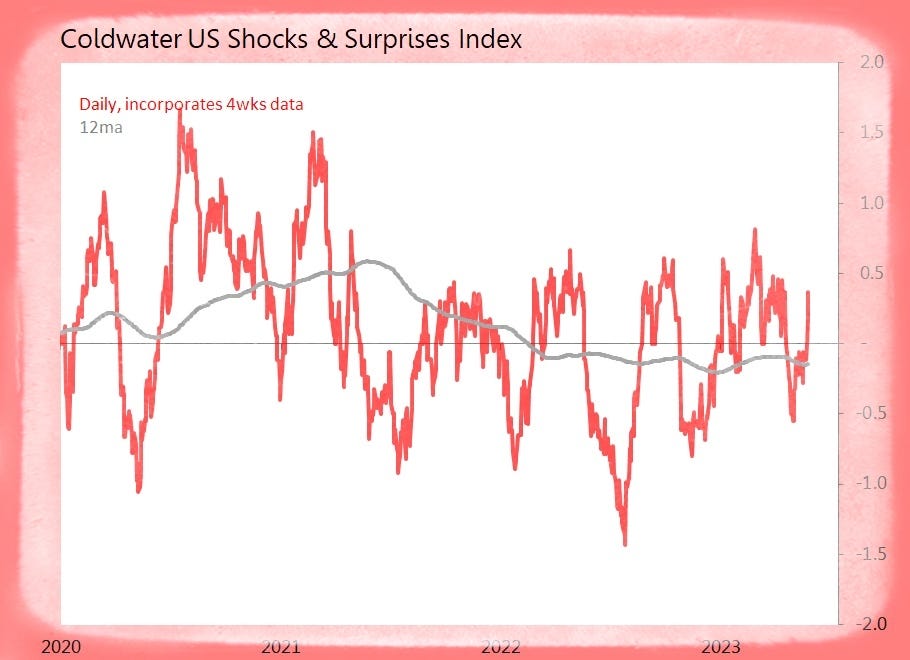

Stasis in the US

Notable Today

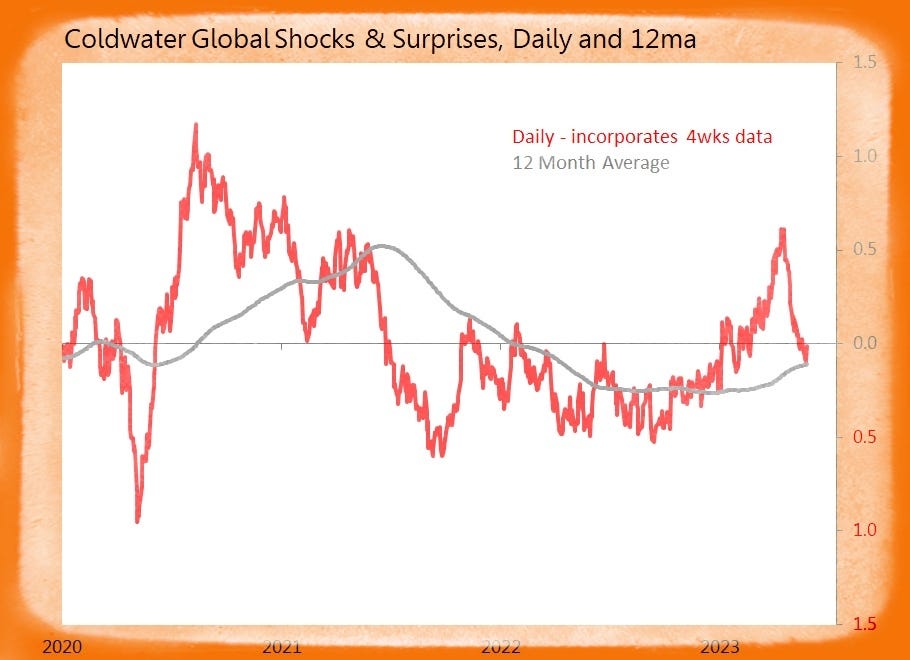

Despite the cacophony of ‘noises off’, major indicators in the US economy suggest nothing so much as cyclical stasis. That stasis showed up twice in today’s data, in core capital goods orders and shipments, and in personal financial stress indicators.

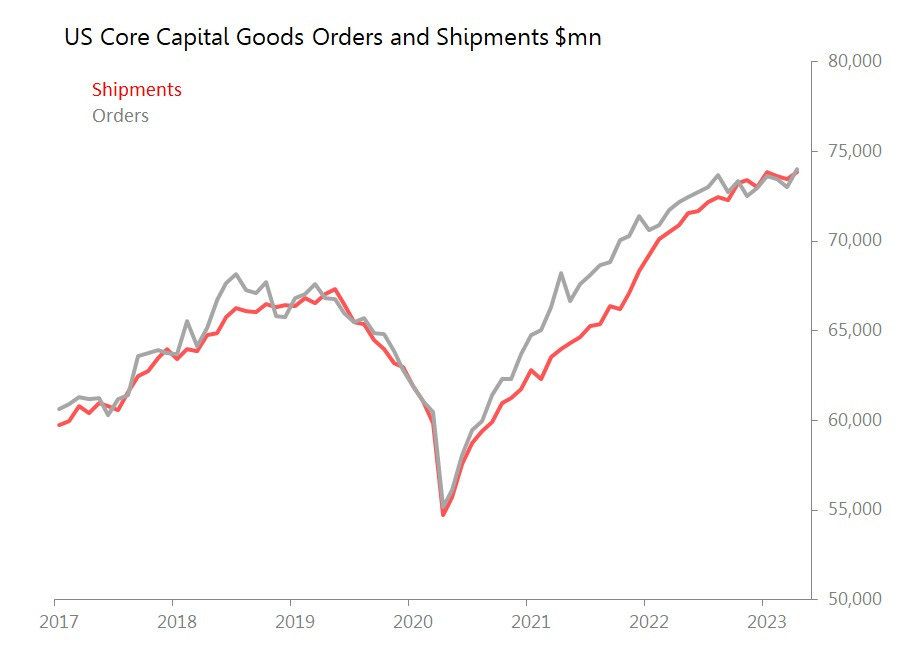

Capital goods orders (ie, non-def, ex-air) rose 1.4% mom and shipments rose 0.5% mom in April. This might suggest a degree of vigour, but, as the chart shows, nominal values have remained little changed now since around August 2022. Neither inventories nor unfilled orders moved much - up 0.2% and 0.1% respectively, so nothing in the core ratios (inventory/shipment, backlogs/shipments) are suggesting any necessary dynamic.

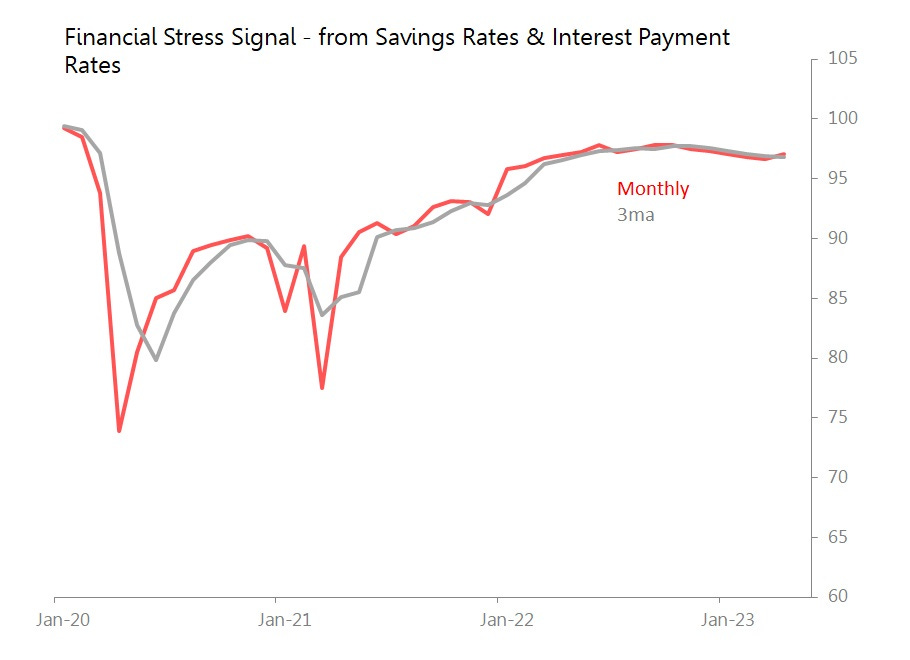

The second ‘stasis’ indicator came from April’s monthly survey of income and spending. Personal income rose 0.4% mom and spending rose 0.8% mom which cut personal saving by 8.7% mom, and the savings rate fell 0.6pps to 4.1%. However interest payments rose only 0.9% mom, equivalent to 2.27% of disposable income - hardly changed on the month.

I construct a household financial stress signal by combining changes in savings ratios and interest rate payments as % of disposable income. What is surprising about this signal is the stasis it has managed since approximately the beginning of 2022. The rise in interest rates and the fall in bank credit and monetary aggregates are seemingly not producing the degree of financial stress on households budgets that are conventionally expected. At least, not yet.

Summary: 23 datapoints tracked today, generating four surprises and three shocks. Surprises mainly came from the US.

US (11 tracked)

Surprise! April Durable Goods Orders Gain +1.1% mom

o Shipments Down 0.7% mom, Inventories +1%, Unfilled Orders +0.8%

o Book-to-Bill up 0.0o2pts to 1.02x, Inventory/Shipments up 0.03pts to 1.88x

o Defence Orders +36.1% mom, with Aircraft +32.7%; Orders ex-Defence Down 0.6%

o Drivers: Machinery +1% mom, Computers +1.8%

o Drags: Primary Metals Down 0.5% mom, Comms Down 0.5%, Electrical Equipt Down 1%, Autos Down 0.1%

Surprise! April Capital Goods Orders (Nondef ex-air) Rise +1.4% mom

o Shipments +0.5% mom, Inventories +0.2%, Inventory/Shipment Unchanged at 1.92x

o Machinery +1% mom, Computers +1.8%, but Comms Equipt Down 0.5%, Electrical Equipt Down 1%

Surprise! April Personal Spending Rises +0.8% mom and +7.3% yoy

o Goods +1.8% mom, with Durables +1.6%, Non-Durables +0.8%, and Services +0.7%

o Income up 0.4% mom, Savings Down 8.7%

o Savings Rate Down 0.4pps to 4.1%

o Interest Payments +0.9% mom, Equivalent to 2.27% of Disposable Income

Shock! April Goods Trade Deficit Widens $14.1bn to $96.8bn

o Exports Down 5.5% mom, with Industrial Supplies Down 9.8%, Consumer Goods Down 7.4%, ‘Other Goods’ Down 11.9%

o Imports +1,8% mom, with Autos +6%, Industrial Supplies +2.7%, Consumer Goods +2.2%

Europe (6 tracked)

Surprise! UK April Retail Sales Volume ex-Petrol Rises +0.8% mom

o Fuel Sales Down 2.2% mom, and Total Sales +0.4%

o Food Sales +0.7% mom, Non-Food Sales +1%, Non-Store Sales +0.2%

o Clothing +0.2% mom, H’hold Goods Down 0.2%

o Drivers: Watches & Jewellery +10.6% mom, Sporting/Recreation +5.2%

o Drags: Computers/Telecoms Equipt Down 11.7%

Shock! Italy May Manufacturing Confidence Falls 1.4pts to 101.4

o Weakest Since Oct 2022

o O’all Economic Sentiment Down 1.7pts to 108.7

o Construction Down 4.8pts, Services Down 1.4pts, Retail Down 1.2pts

Asia (6 tracked)

Shock! Japan April Services PPI Rises +1.6% yoy

o Monthly Rise of 0.2% mom is 0.9SDs Above Historic Seasonal Trends

o Inflation Drivers: Leasing & Rental +4.6% yoy, Real Estate Servs +1.5%, ‘Other Servs’ +2.7%

o Inflation Dampers: Transport & Postal Unchanged yoy, Infocomms +0.5%, Advertising +0.6%