Macro Kernel - 26th April

Notable Today

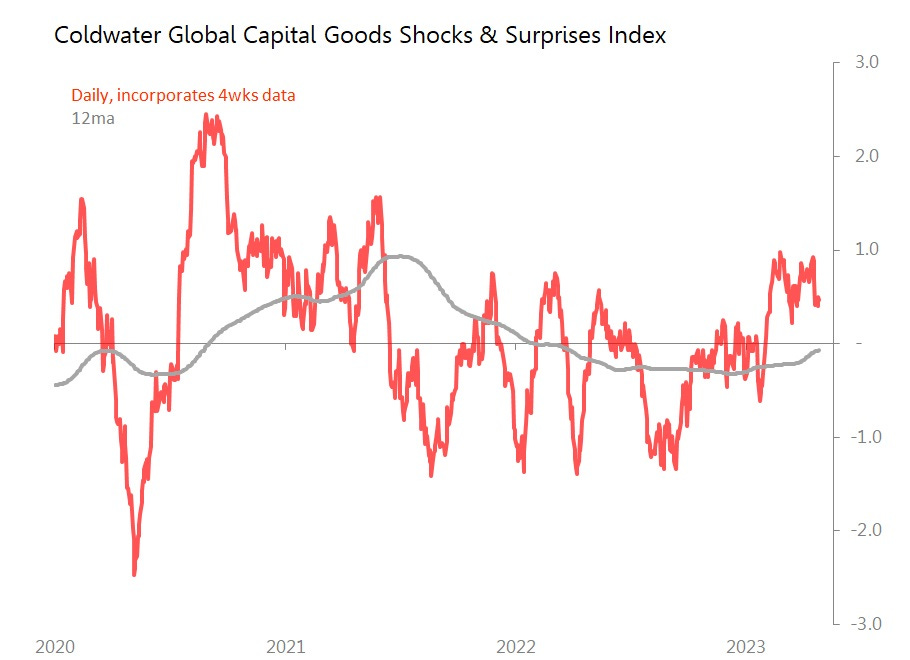

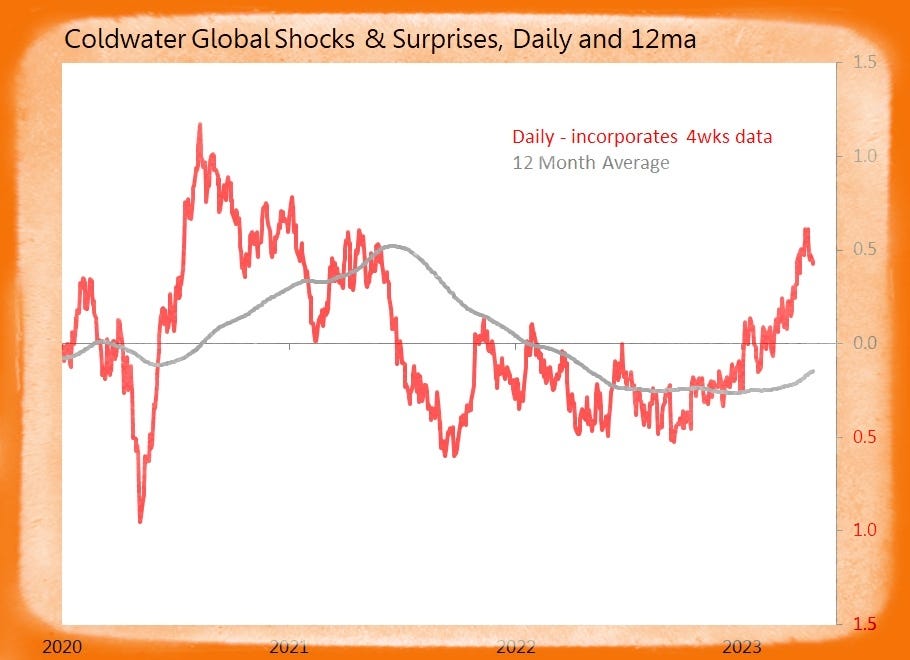

Since the beginning of the year, capital goods indicators have tended to surprise, modestly, for the longest sustained period since 1H21. It remains a fragile recovery, though, and evidence from the US suggests we should expect little positive momentum in coming months.

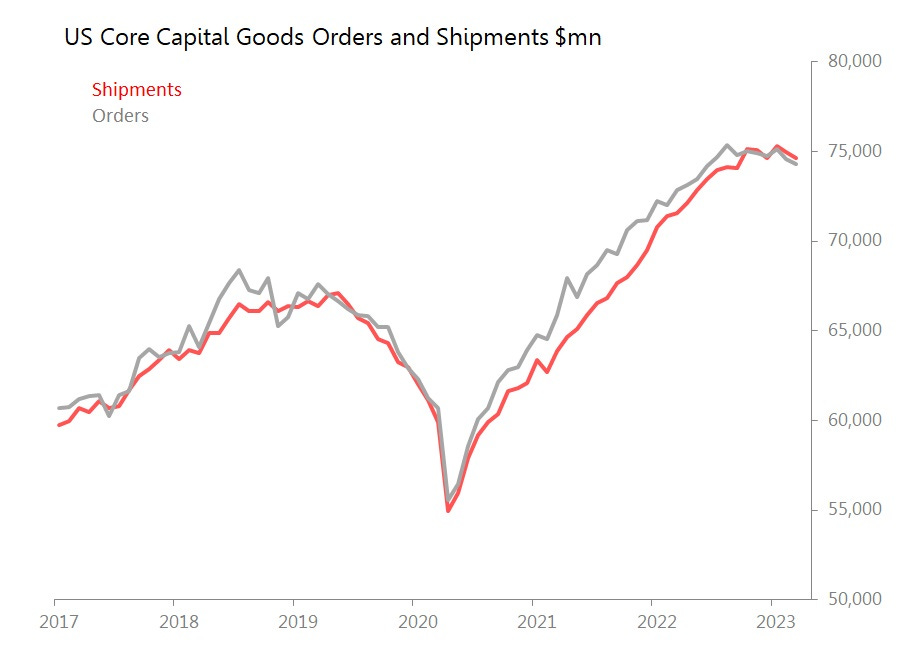

This was seen again in March’s US core capital goods orders and shipments data, which showed core capital goods (ie nondef ex-air) orders and shipments both down 0.4% mom. By themselves these are disappointing but not disastrous: however, they extend a plateau in orders which peaked in August 2022, and in shipments which peaked in October 2022. Re-tooling post-covid is plainly over.

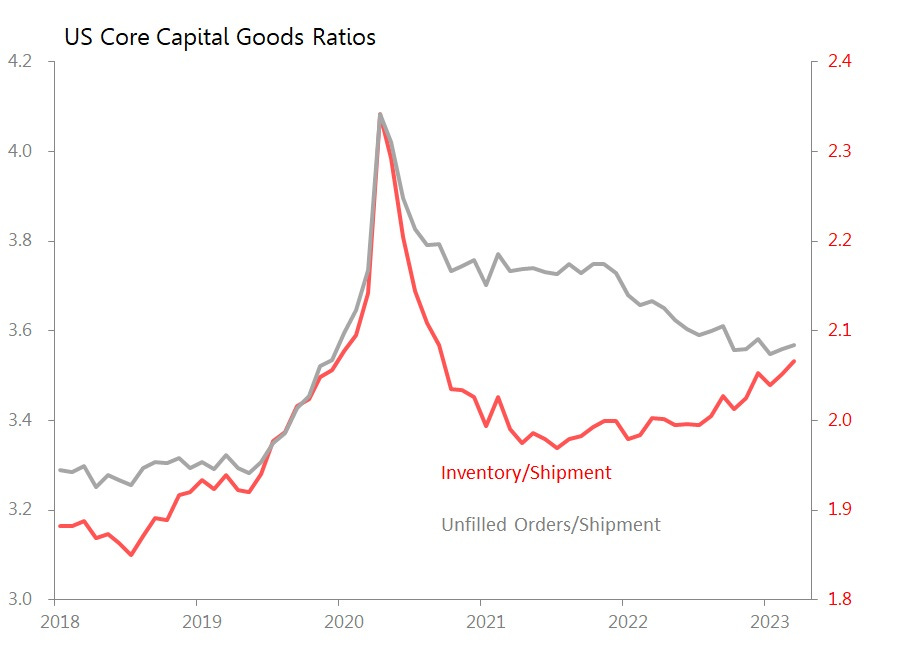

The danger is less of a sudden collapse than a continued and sustained leaking away of momentum. This is what is suggested by the key ratios for the US core capital goods sector, where the inventory/shipment ratio continues to climb, and in March had reached the highest point since mid-2020. Meanwhile, unfilled orders continue to be very gently eroded, down a further 0.1% mom - this is the sixth consecutive month where backlogs have either fallen or have been static.

No reason, then, to expect an early upward breakout from the current static levels of supply and demand for core capital goods. But some modest grounds to expect the current stasis to trend towards deterioration.

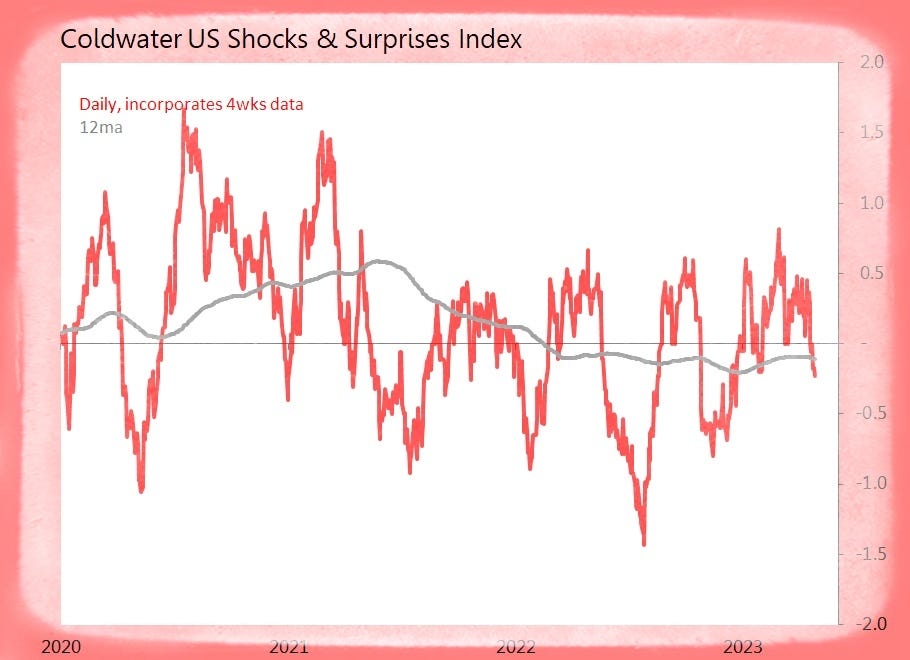

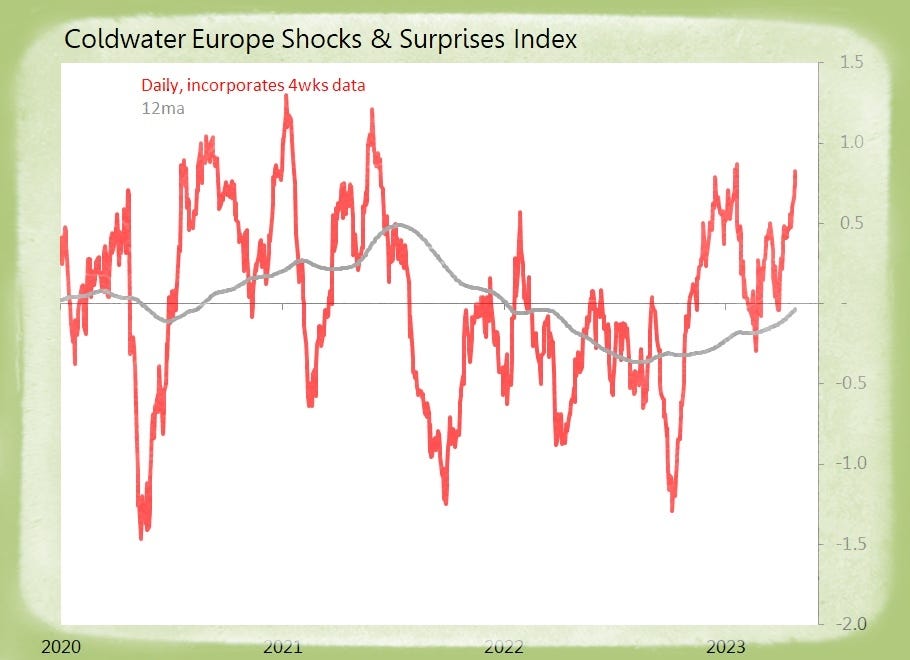

Summary: 19 data releases tracked, generating five surprises and two shocks. The global index appears to have peaked for now, with both US and Asia in retreat.

US (8 tracked)

Shock! March Capital Goods Orders (Nondef ex-air) Shocks Fall 0.4% mom

o Unadjusted Orders +1.9% yoy

o Motor Vehicles Down 0.1% mom, Comms Equipt Down 0.2%

o Machinery +0.1% mom, Computers & Related +1.8%, Electrical Equipt +0.8%

o Shipments Down 0.4% mom, Inventories +0.2%, with Inventory/Shipment up 0.02pts to 2.07x

Surprise! March Goods Trade Deficit Narrows $7.4bn to $84.6bn Only

o Exports +2.9% mom, with Industrial Supplies +6.4%, Autos +4.3%, ‘Other Goods’ +7.6%

§ FF&B Down 4.5% mom, Capital Goods +0.3%

o Imports Down 1% mom, with Capital Goods Down 2.9%, Industrial Supplies Down 2.7%

§ Consumer Goods +2.4%

Europe (4 tracked)

Surprise! Germany May GfK Consumer Confidence Rises 3.6pts to Minus 25.7

o Best Since April 2022

o April Expectations: Economy up 10.6pts to 14.3, Income up 13.6pts to Minus 10.7

o Propensity to Buy up 3.9pts to Minus 13.1

Asia (7 tracked)

Surprise S Korea April Consumer Confidence Jumps 3.1pts to 95.1

o Best Since June 2022

o Economic Conditions: Current up 6pts to 58, Prospective up 5pts to 68

o Current Living Standards up 4pts to 87, Prospective up 3pts to 90

o Employment Prospects up 4pts to 74

o Prospective H’hold Income and Spending both Unchanged

Surprise! Thai March Trade Balance Improves US$1.26bn yoy to $2.72bn Surplus

o Exports Surprise, Down 4.2% yoy, with Monthly Movt 1.5SDs Above Trend

o Imports Shock, Down 9% yoy, with Monthly Movt 1.2SDs Below Trend