Macro Kernel - 24th May

Notable Today

The UK’s April yoy CPI enjoyed an outrageously friendly base of comparison, since in April 2022 CPI rose by no less than 2.5% mom - a ‘statistically impossible’ break above 5yr seasonalized trends which at the time were running at +0.4% mom. So April should have been the first month at which the yoy should have fallen conspicuously.

It didn’t, and the 8.7% yoy result was generated by a 1.2% mom rise which was 2.4SDs above historic seasonal trends. Two elements continue to do the damage: energy and food.

Government’s energy price policies allow consumers to benefit from falling international prices of energy commodities (oil, gas) only very slowly. And so in April’s CPI electricity/gas/fuels prices were up 24.3% yoy, although (unregulated) CPI liquid fuel prices were down 27.2%, and international gas prices were down no less than 67.5% yoy (in dollar terms).

Regulators now re-set consumer energy price caps on quarterly basis, with a substantial fall to be announced imminently. This will show up only in July’s CPI (to be announced in August). A further fall can be expected - but this will have to wait until October’s CPI (to be announced in November) .

The conspicuous food inflation is more difficult to explain, with processed foods and (dry) bev up 21.1% yoy, with non-processed foods up 16.4% yoy. Why? Last year’s sharp rise in key food prices have already fully reversed, with international prices of corn falling 19.2% yoy and wheat down 37.3% yoy in April. For May so far, corn is down 26.1% yoy and what is down 44.8%. So it is difficult to know why bread rose 16.8% yoy, and biscuits/cakes rose 21.6%. The most obvious explanation is that the jump in regulated energy prices are being simply passed through. When falling energy prices are eventually allowed to be recognized in the UK, will these prices fall in response?

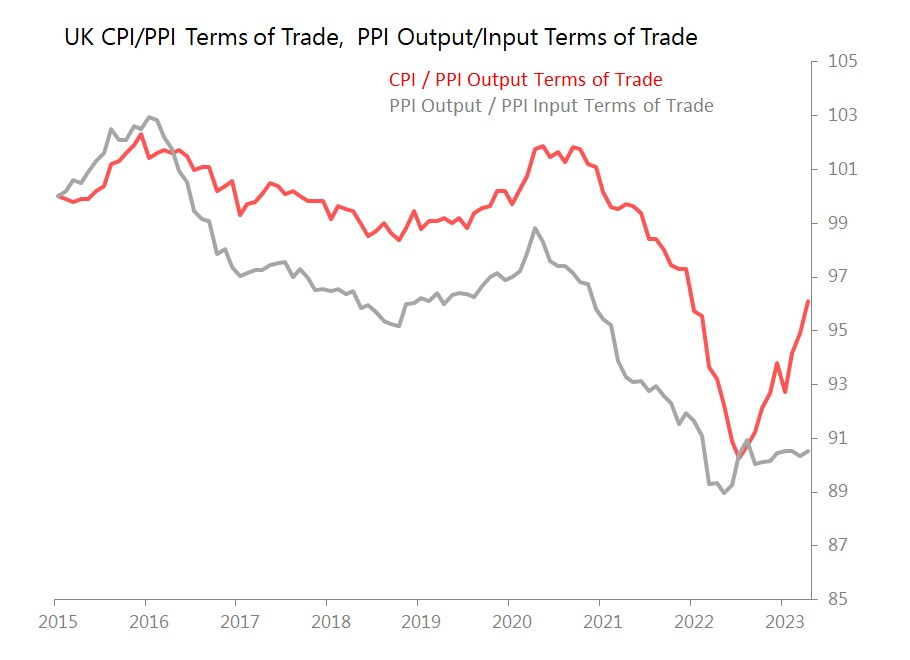

We can track the way in which a rise in input prices are passed through to consumers through looking at the changes in terms of trade between producers’ input prices and output prices, and between producer’s output prices and CPI. Here the rule is that we expect producers to pass rises in input prices through to output prices, and for distributors to pass through the rise in output prices to consumers. Each are trying to protect margins lost in 2021-2022. The chart below shows how this is progressing.

There is good news: by raising consumer prices, distributors have almost completed the restoration of their margins, with the terms of trade now back within touching distance of pre-pandemic levels. In April, whilst CPI rose 1.2% mom and 8.7% yoy, output PPI rose only 5.4% yoy, with a 0.1% mom fall which was 2.8SDs below historic seasonal trends.

However, the downside to this is that output producers are making almost no headway in restoring their prices relative to the input prices they have to pay. The key reason why output PPI dropped 0.1%$ mom in April was that input prices dropped 0.3% mom and rose only 3.9%. For the time being, in the short term the fall in global agricultural and industrial commodity prices means further input prices are secured.(So far this month, copper down 7.7% mom in dollar terms, aluminium down 4%, zinc down 9.5% and tin down 6%. )

The medium-term outlook for UK CPI, then, depends not only on predicted falls in regulated energy prices, but also in global demand - and particularly Chinese demand - continuing to slacken.

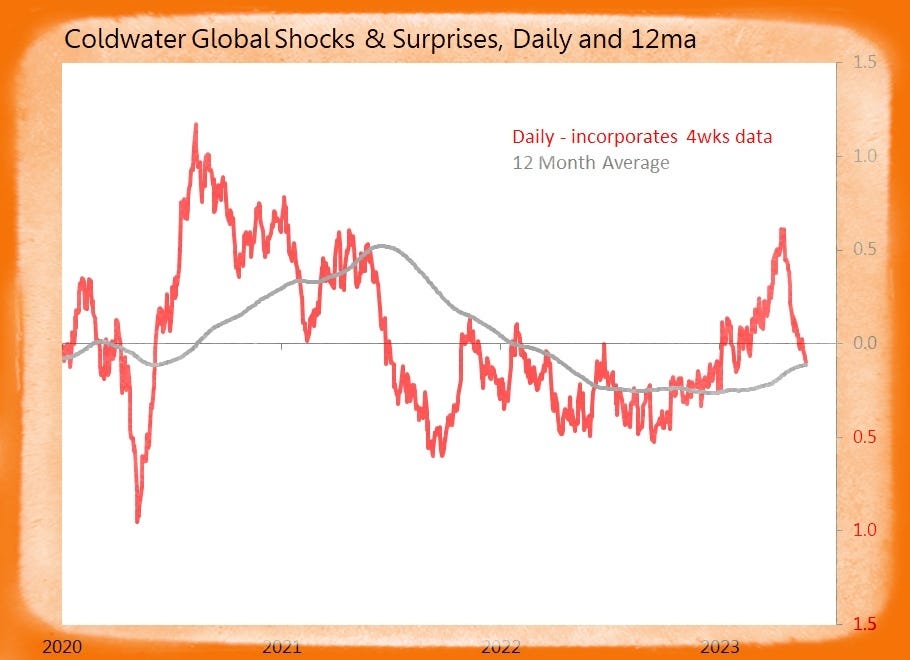

Summary: Only 14 releases tracked today, generating three shocks, all coming from Europe.

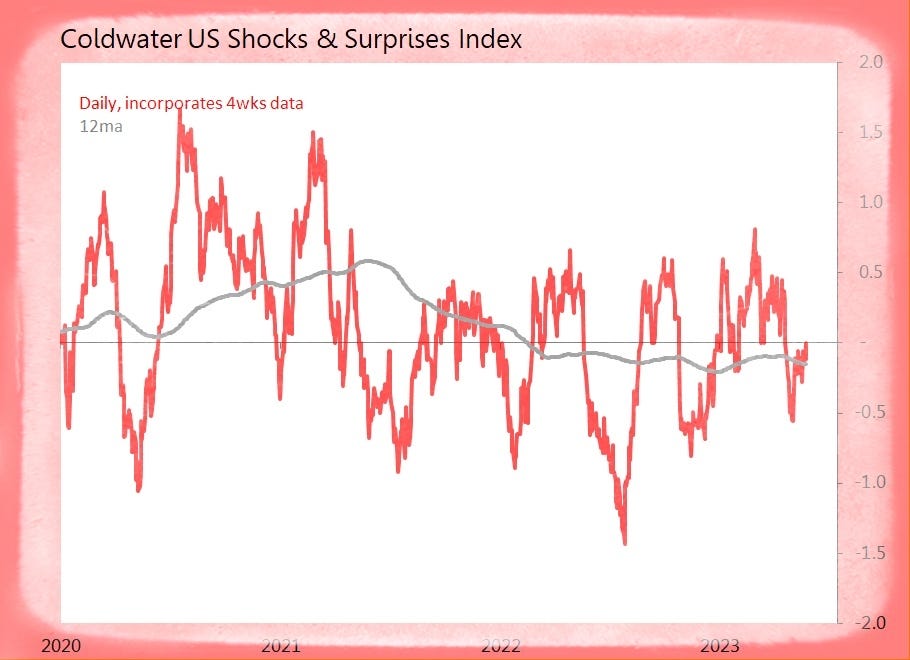

US (1 tracked)

· None – Sole Datapoint Stays Within Range

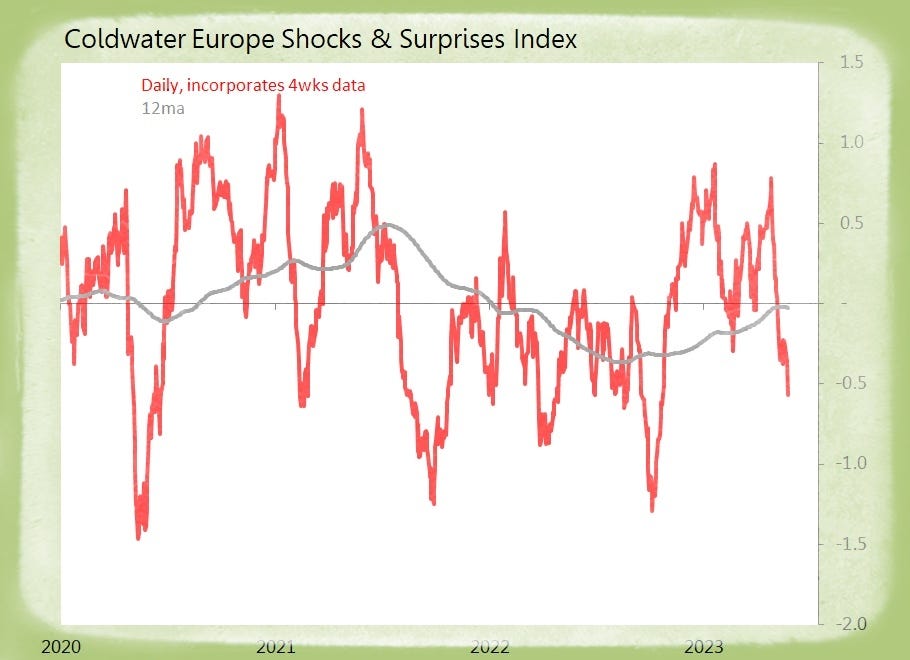

Europe (7 tracked)

Shock! Germany May Ifo Survey – Business Climate Drops 1.7pts to 91.7

o Current Conditions Down 0.3pts to 94.8, Expectations Down 3.1pts to 88.6

o DI for Germany Down 3.8pts to 0.3

o Manufacturing CI Down 6.6pts to Minus 0.3

o Wholesale/Retail Minus 19.1, Construction Minus 18.2, Services +6.8

Shock! Germany May Ifo Survey – Expectations Drop 3.1pts to 88.6

o Weakest Since Feb

o Manufacturing Expectations Drop Sharpest Since March 2022, Start of Ukraine War

o Services More Pessimistic, Retail/Wholesale Expectations, Construction’s Pessimism Almost Unchanged

Shock! UK April CPI +8.7% yoy

o Monthly Rise of .12% mom is 2.4SDs Above Historic Seasonal Trends

o Inflation Drivers: F&B (Dry) +19% yoy, Housing & H’hold Services +12.3%m Hostelry +10.2%

o Standouts: Electricity & Fuels +24.3% yoy, Insurance +17.9%

o Inflation Dampers: Transport +1.5% yoy, Education +3.2%

o O’all Goods +10% yoy, Services +6.9%