Macro Kernel - 21st April

Notable Today

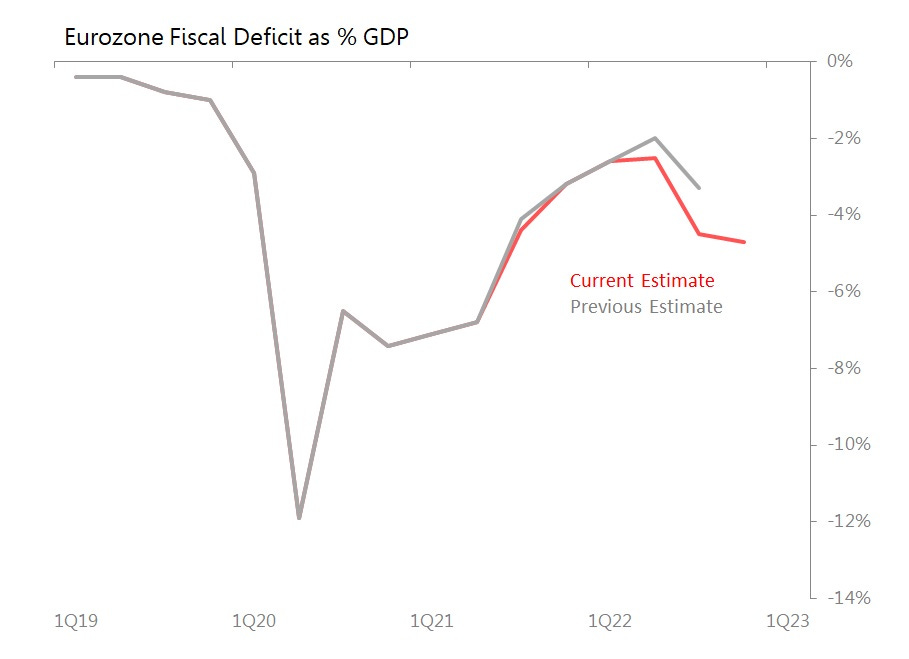

From a Keynesian point of view, the news that Eurozone governments started expanding their fiscal deficits again in 2Q22, earlier than previously thought, and did so far more aggressively than previously reported, is encouraging. Today, Eurostat reported deficits of 2.5% of GDP in 2Q22 (previously 2%), expanding to 4.5% in 3Q22 (previously 3.3%) and running to 4.7% in 4Q. These are significant upward revisions.

Eurozone government spending was equivalent of 51.6% of GDP (unchanged from 3Q22, but up from 47% in pre-Covid 2019)) and revenues raised amount to 46.9% of GDP (down 0.2pps from 3Q, but up 0.9pps from pre-covid 4Q19).

Within those revisions, there are some really quite serious deficits. Of the main Eurozone economies; France came in at 6.1% of GDP (up from 4.4% in 4Q 21); Spain 7.6% of GDP (vs 3.7%), and Germany 3.2% of GDP (vs 1.8%). About Italy, rather alarmingly Eurostat has published no fiscal balances at all for the last few years. Ditto Greece. One can only guess.

Signals from the first three months of this year suggest the deficits are still expanding: in the first three months Germany’s deficit came to Eu30.06bn, only slightly larger than the Eu28.34bn deficit in 1Q22. But over in France, the deficit in Jan-Feb came to Eu50.3bn, compared with Eu37.6bn in the same period last year. We can expect the 1Q23 deficit to be running larger than 4Q’s 4.7% of GDP.

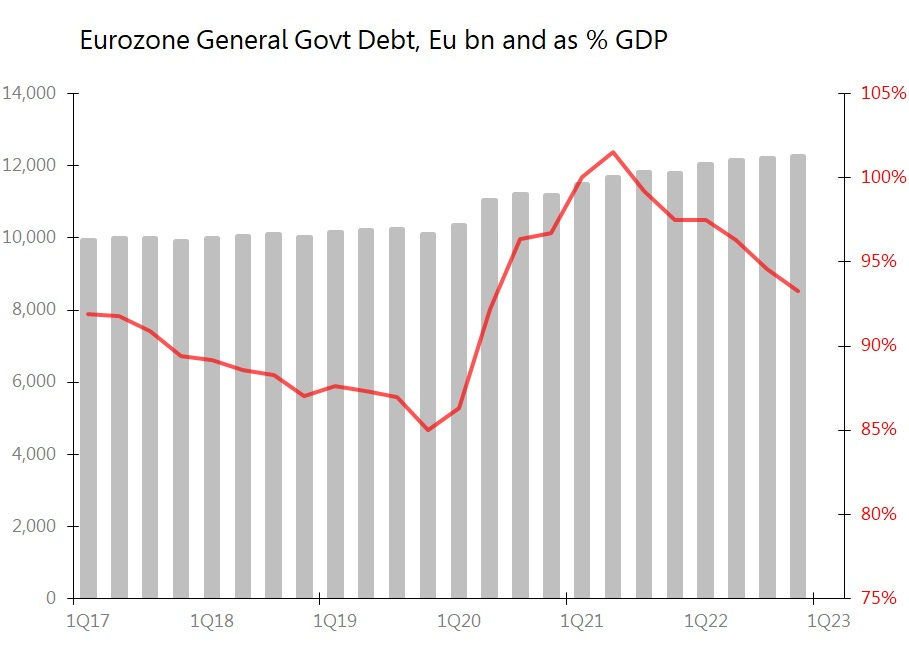

However, the pace of growth of government, having slowed against trend during 2Q and 3Q last year, once again started accelerating in 4Q. By the end of the year, outstanding government debt was up 3.8% yoy (vs 3.4% in 3Q), but with 12m nominal GDP growing at 8.4%, the debt/GDP ratio declined to 93.3% of GDP. That was down 1.3pps from 3Q22 and 4.2pps from 4Q21 - inflation doing a fine job of deflating away Eurozone government debt.

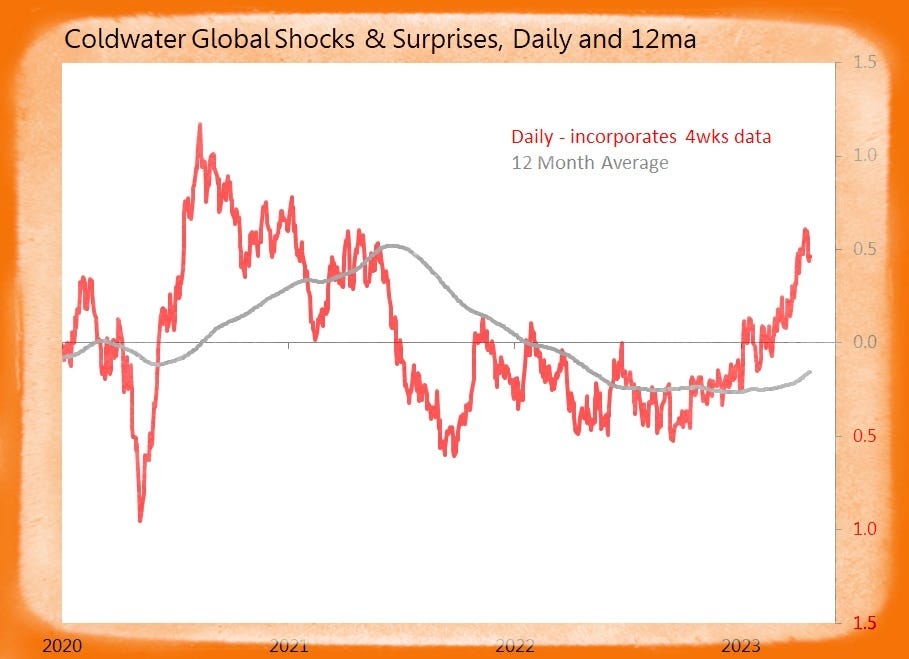

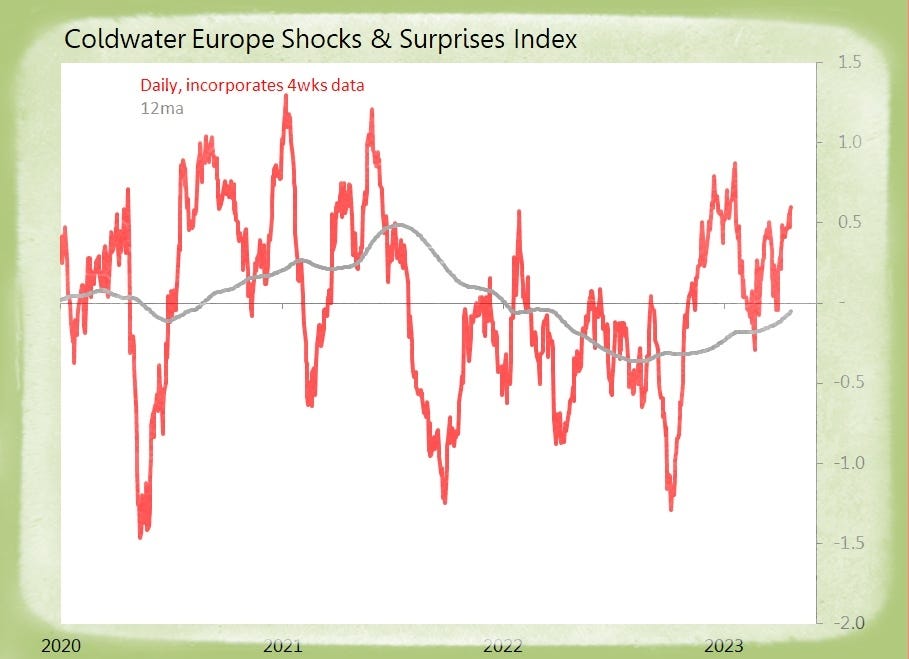

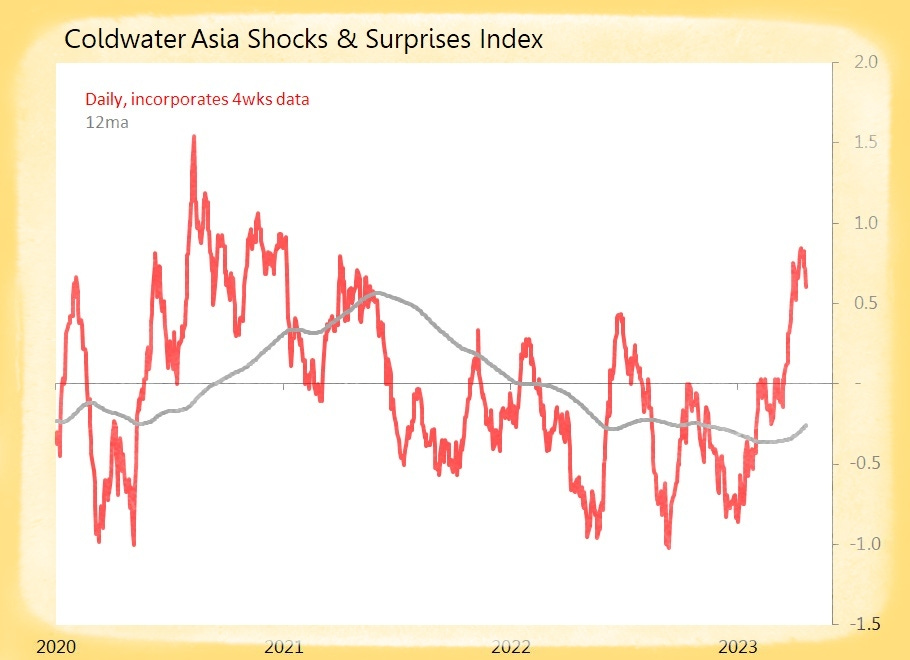

Summary: 20 datapoints tracked today, generating five surprises and two shocks. But for now, the rise in the global index has stalled.

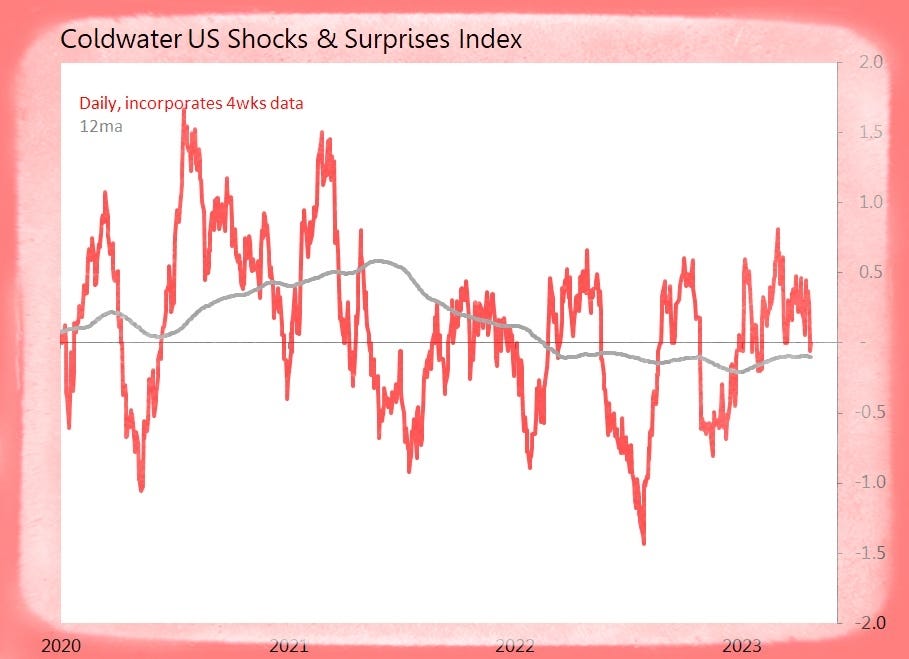

US (2 tracked)

Surprise! April Markit Manufacturing PMI prelim Gains 1.2pts to 50.4

o First 50+ Result Since Oct 2022

o New Orders Rise Fractionally, First Rise in 7m, Despite Falling Export Orders

o Output Index up 2.6pts to 52.8, Best in 11 Months

o Backlogs Fell for 7th Month, Inventories Rose

o Optimism Best for 3m, Payrolls Rise Most Since Sept 2022

o Input Inflation Quickest Since Nov 2022, Selling Prices Rise Sharply

Europe (12 tracked)

Shock! Eurozone 4Q Fiscal Deficit Records 4.7% of GDP

o 3Q Also Revised Higher

o Revenues Down 0.2pps to 46.9% of GDP

o Spending Unchanged at 51.6% of GDP

o Deficits: Germany 3.2%, France 6.1%, Spain 7.6%, Italy n/a

Shock! Germany March Federal Budget Shows Surplus of Eu0.6bn Only

o Revenues Down 1.6% yoy, with Monthly Movt 0.6SDs Below Trend

o Spending Down 0.8% yoy, with Monthly Movt 0.8SDs Below Trend

o 1Q Deficit Widens Eu1.66bn yoy to Eu30.056bn

Surprise! UK April GfK Consumer Confidence Rises 6pts to Minus 30

o Least-Bleak Since Feb 2022

o Expectations: Personal Finances up 8pts to Minus 13, Economy up 6pts to Minus 34

o Major Purchases up 5pts to Minus 28, Savings Down 2pts to 19

o Assessment of Previous 12m: Personal Finances up 5pts to Minus 21, Economy up 7ptgs to Minus 55

Surprise! France April Markit Services PMI prelim up 2.4pts to 56.3

o Suggests Briskest Business Since May 2022

o New Orders Accelerate, with Export Orders Also Rising; Work Backlogs Rise

o Payrolls Growth Accelerate, and Input Inflation Remains Sharp as Salaries Rise

o Output Inflation Softens

Asia (6 tracked)

Surprise! Hong Kong 2Q Business Expectations Rise 9pts to net +15

o Most Positive Since at Least 2013

o Expecting Improvement up 6pts to 25, No Change Down 3pts to 65, Expecting Deterioration Down 3pts to 10

o Most Positive: Hostelry 64, Manufacturing 36, Retail 24

o Negative: Prof/Business Servs Minus 4

Surprise! S Korea March PPI Rises +3.3% yoy Only

o Monthly Rise of 0.1% mom is 1SD Below Historic Seasonal Trends

o Manufacturing Products +0.5% yoy, Ag/For/Fish +4.4%, Services +3.2%

o Domestic PPI +2.5% yoy, with Raw Materials Down 0.1%, Intermediates +2.4%, Final Demand Goods/Servs +3.5%