Macro Kernel - 20th April

Taiwan export orders, Japan business services - both bad

Notable Today

If it were possible to find some rays of light in Taiwan’s March export orders, I’d highlight them, I promise. But the truth is they were unremittingly bad, falling 25.7% yoy against against a weak base of comparison in March 2022. In fact the monthly movt was no less than 3.1SDs below trend. Core electronics dropped 29.4% yoy and infocomms equipt fell 26.3% - there were no positive sectors offsetting the bad news. Similarly, orders from China & HK dropped 33.8% yoy, US fell 20.7% and Europe fell 33.8% - and again, there were no hungry markets offsetting those falls.

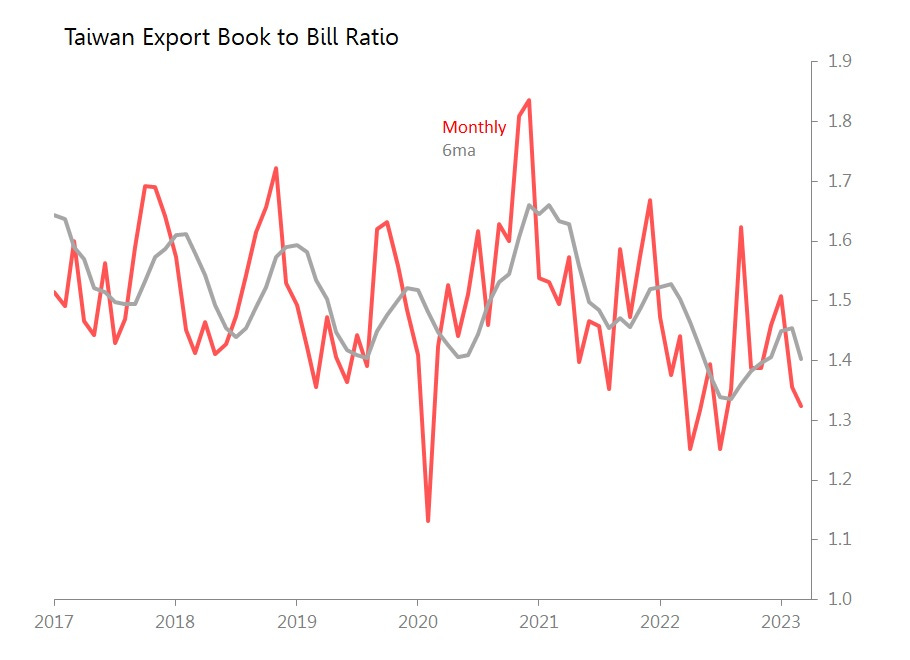

Taiwan remains the world’s principle supplier of high-end semiconductors, used in every mid-to-high end industrial and consumer product. Right now they can’t find buyers, and March’s book-to-bill ratio is down at 1.32x, vs the 5yr av for March of 1.42x.

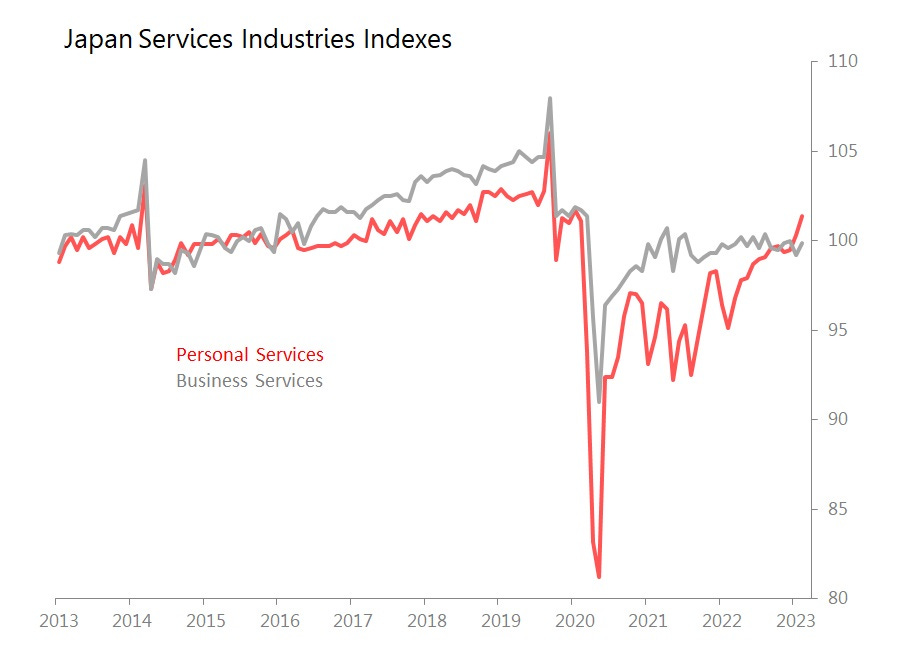

Japan also smuggled in some poor news among the 0.7% mom rise in Feb’s tertiary industries index - and that is that services for business are not recovering from the pandemic’s pounding. Whilst personal services have recovered to just 0.3% mom below Jan 2020 levels, business services are 2% below that level, and have been essentially flat since the beginning of 2021, with no current signs of recovery.

Which services for business have been on the canvas since Jan 2020? Advertising is down 14.5% from then, wholesale is down 12%, fleet maintenance is down 12.2%, comms are down 8%, and technical services are down 6.1%.

What’s recovered? Mainly info services up 12% and finance/insurance up 10.9%.

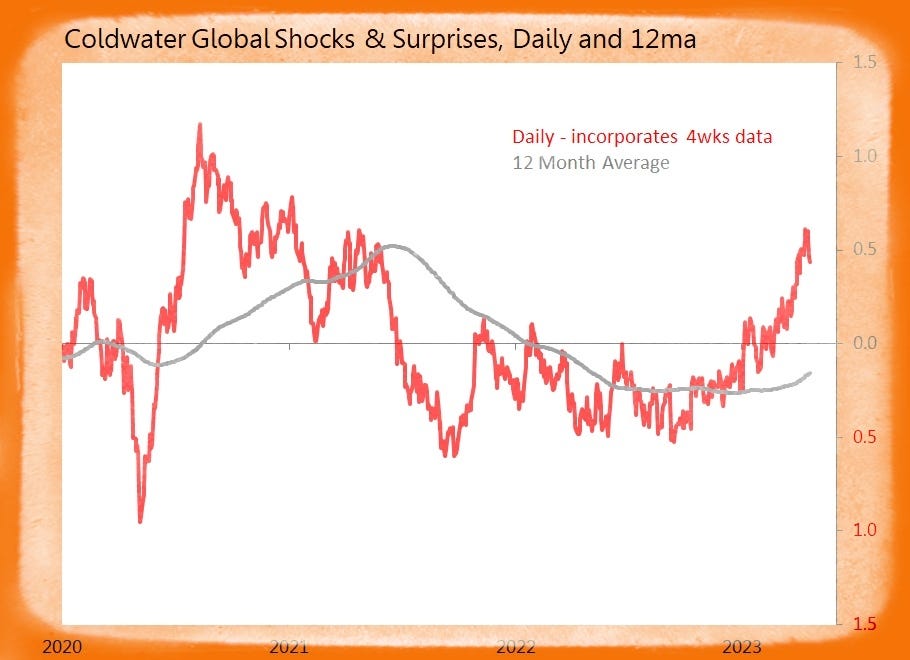

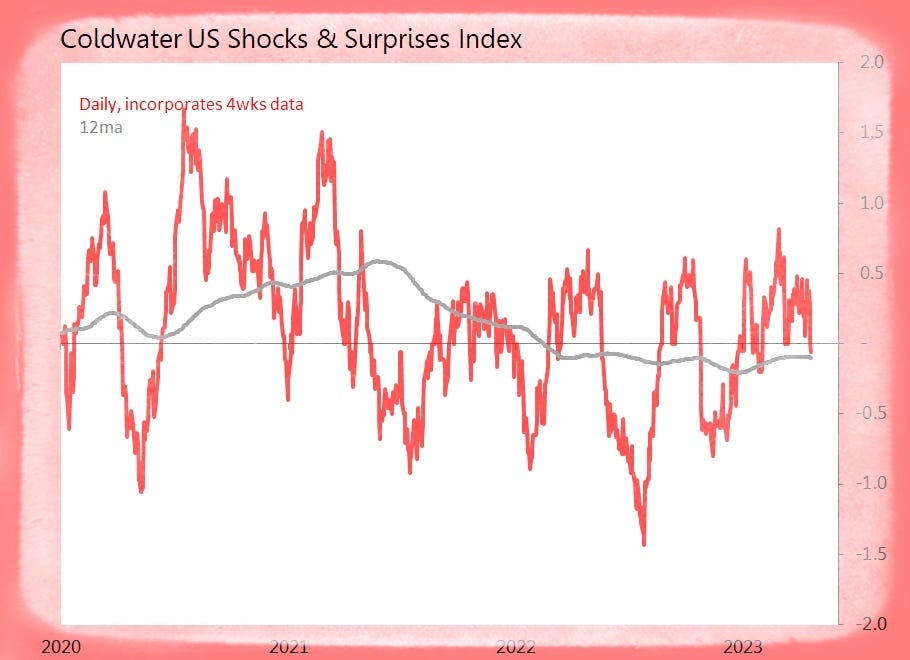

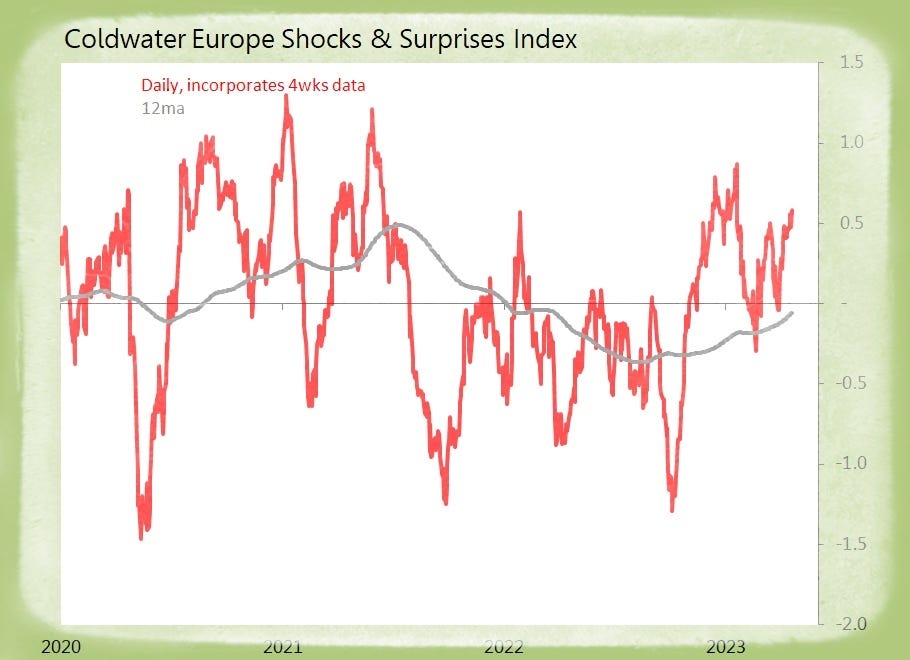

Summary: 21 data releases examined today, generating five surprises and seven shocks.

US (6 tracked)

Shock! April Philadelphia Fed Business Outlook Drops 8.1pts to Minus 31.3

o Weakest Since May 2020

o New Orders up 5.5pts to Minus 22.7, Shipments up 18.1pts to Minus 7.3

o Backlogs up 10.2pts to Minus 11.1, Inventories Down 6.7pts to Minus 17.9

o Payrolls up 10.1pts to Minus 0.2, Av Workweek up 13.6pts to Minus 8.4

o Prices Paid Down 15.3pts to 8.2, Prices Received Down 11.2pts to Minus 3.3

Shock! March Conf Board Leading Index Falls 1.2% mom

o Index Down 4.5pps Over 6m, with Non-Financial Components Down 3.4pps, Financial Components Down 0.6pps

o Coincident Index up 0.2% mom, Lagging Index Down 0.2%

Shock! Weekly Continuing Jobless Claims Jump 61k to 1.865mn

o California is 24.2% of Total, New York 9.3%, New Jersey 5.5%; Texas 6.7%

o Insured Unemployed Rate up 0.1pp to 1.3%

o California 2.4%, New Jersey 2.4%, Massachusetts 2.2%

Surprise! Weekly Total Benefits Claimants Fall 50k, or 2.7%, to 1.822mn

o Lowest Since Dec 2022

o Regular State Benefits Down 48.6k, STC/Workshare Down 0.9k, Federal Employees Down 0.5k

Europe (9 tracked)

Surprise! Eurozone April Consumer Conf advance Rises 1.6pts to Minus 17.5

o Least-Bad Since Feb 2022

o No Details Given with Advance

Shock! Eurozone Feb Imports Gain +1.1% yoy Only

o Monthly Movt is 1.2SDs Below Historic Seasonal Trends

o Seasonally Adjusted Down 3.4% mom, with

o Germany Down 4% mom sa, France Down 3.9%, Spain Down 1.3% Italy +0.4%,

Surprise! Eurozone Feb Seasonally Adjusted Trade Balance is Exactly Balanced

o Balance Improved Eu11.6bn mom

o Exports +1.2% mom sa, Imports Down 3.4% mom

o German Surplus up Eu4.7bn mom to Eu20.3bn, France Deficit Narrowed Eu0.9bn mom to Eu0.2bn

o Italy Surplus Rises Eu0.2bn mom to Eu3.6bn, Spain Deficit Narrows Eu0.2bn to Eu5bn

Surprise! Eurozone Feb Trade Balance nsa Surprises up Eu14bn yoy to Eu4.6bn Surplus

o Exports +7.6% yoy, with Monthly Movt 0.1SD Below Historic Seasonal Trends

Imports +1.1% yoy, with Monthly Movt 1.2SDs Below Trend

Surprise! Germany March PPI Rises +7.5% yoy Only

o Monthly 2.6% mom Fall is 2SDs Below Historic Seasonal Trends

o Energy Down 7.6% mom and +6.8% yoy Only

o PPI ex-Energy +0.2% mom and +7.9% yoy

o Intermediates +4.7% yoy, Capital Goods +7.5%, Durables +10%

o Consumer Goods +15.4% yoy, and Food Prices +19.2%

Shock! France April Manufacturing Climate Shocks Down 2.4pts to 1.1.1

o Lowest Since Nov 2022

o Production Expectations: Personal Down 5pts to 5, General Down 3pts to Minus 4

o O’all Orders Down 4pts to Minus 17, with Foreign Unchanged at Minus 9

o Expected Selling Prices Down 15pts to 13, Expected Workforce Down 5pts to 11

o Sectors: Rubber & Plastics Down 8pts, Basic Metals Down 3pts, Computer/Optical Down 3pts, Chemicals Down 2pts

Asia (6 tracked)

Shock! Taiwan March Export Orders Drop 25.7% yoy

o Monthly Movt is 3.1SDs Below Historic Seasonal Trends, More Than Overturning Feb’s 1.5SD Surprise

o Core Electronics Down 29.4% yoy, Infocomms Down 26.3%, Metals Inds Down 28.3%, Rubber/Plastics Down 34.2%

o No Sectors Provide Positive Offset

o US Down 20.7% yoy, Europe Down 33.8%, China & HK Down 33.8%, Asean Down 14%

o No Major Countries Provide Positive Offset

Shock! Japan March Imports Rise +7.3% yoy Only

o Consensus is Optimistic, as Monthly Movt is 0.1SD Only Below Trend

o China +12.3% yoy, Asean +12.6%, Australia +15.6%, US +9.6%, Middle East +12.1%

o Drag: EU Down 6.3%

o Drags: Chemicals Down 15% yoy, Non-Ferrous Metals Down 34.6%

o Drivers: Transport Equipt, Power Generating Equipt +57.6%, Petroleum Products +35.3%, Coal +28.4%