Macro Kernel - 16th May

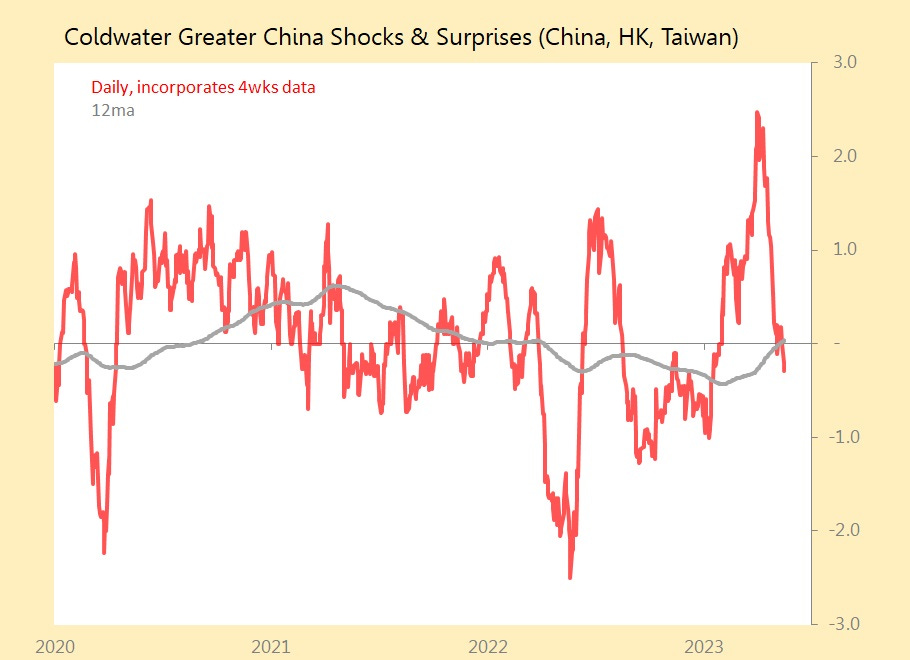

China's recovery/re-opening is stalling, needs help

Notable Today

China's April data tells us there's little underlying cyclical momentum once the authorities take their foot off the credit accelerator. Remember, April's lending and monetary data showed a monetary stimulus being withdrawn, with Rmb bank lending rising only Rmb710, which was only Rmb 60bn above the amount of new lending in April 2022, and the monthly movt was 0.7SDs below historic seasonal trends. Take into account all other funding sources, and aggregate financing rose by only Rmb930bn, the main other sources being government and corporate bond offerings.

The pattern of China's commodity imports, reported both by China itself and also by Australia, has consistently warned that there's no significant industrial momentum. Although April's 5.6% yoy rise in industrial production may seem reasonable, it was made against a very favourable base of comparison, and the monthly movement was a very disappointing 1.3SDs below historic seasonal trends. There's a similar story for electricity product - up 6.1% yoy but with a monthly movt 1.5SDs below trend. These are not good numbers.

Most telling is what is HK & Taiwan invested companies are doing: they are sweating their assets as hard as they can, without re-investing - their output was up 11.8% yoy but their investment was down 4.3% ytd.

Also telling is the pattern of investment spending: the SOE-dominated (rust-belt) Northeast is up 9.8% ytd, and prosperous East is up 6.2%, but the West is up only 3.2% and the central provinces are down 1.3%. This economic neglect of the Central Provinces, in particular, runs counter to decades of public policy, and looks defensive - a circling of the wagons.

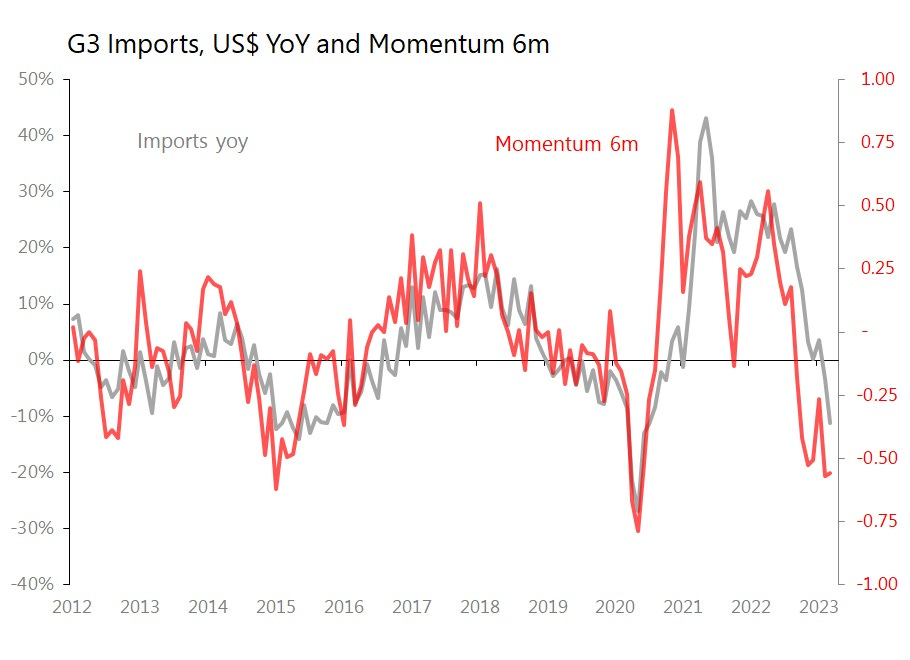

With the domestic economy resisting take-off (yes, retail sales were up 18.4% yoy but the monthly movt was 0.1SD below historic seasonal trends), China's cycle will rest more heavily on external demand. Yet, imports from the M3 (US, Eurozone, Japan) are hardly encouraging, with imports falling in yoy terms, and, more importantly, with underlying sequential momentum about as discouraging as we've seen in the last decade, excluding the initial onset of the pandemic.

April's results are the clearest indicator yet that China's re-starting/recovery cycle has not gathered momentum. So we should absolutely expect further stimulus. Here's a chart of the Rmb.

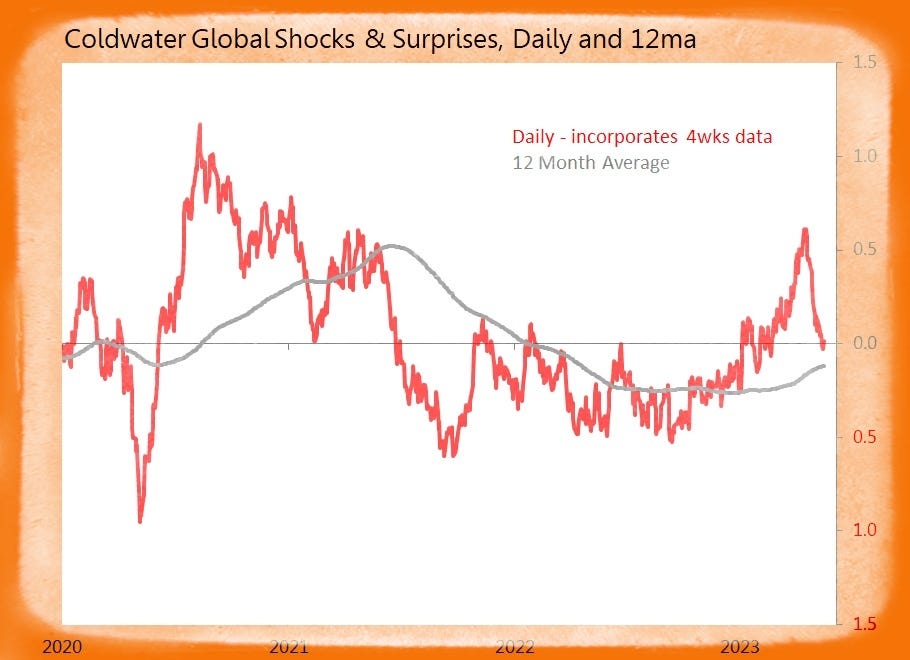

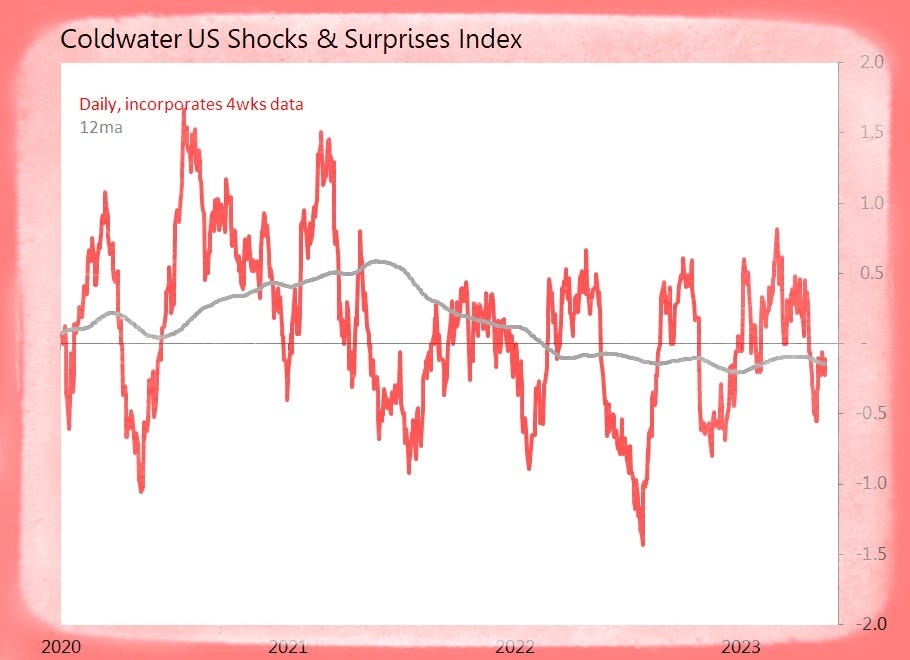

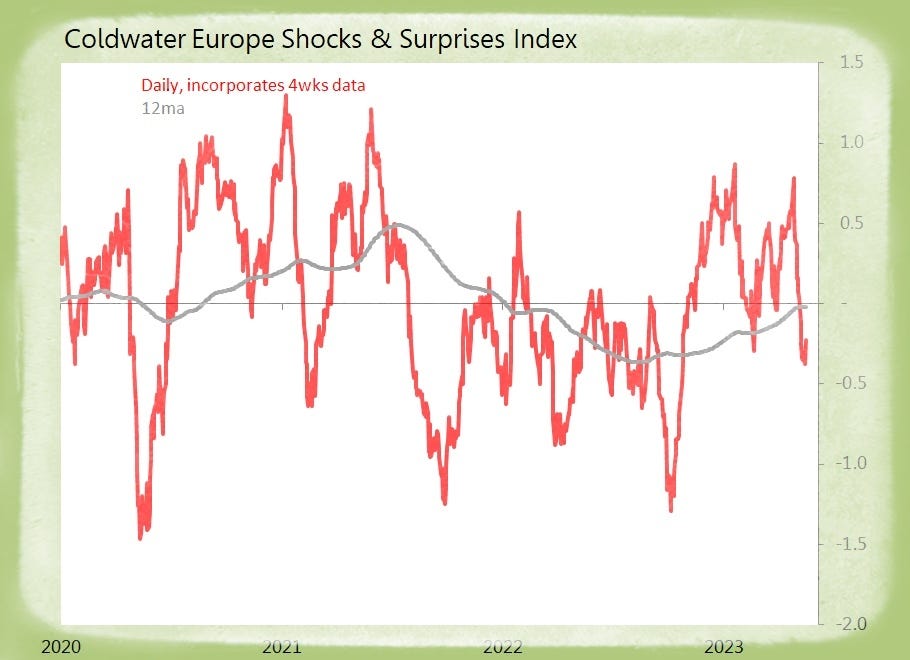

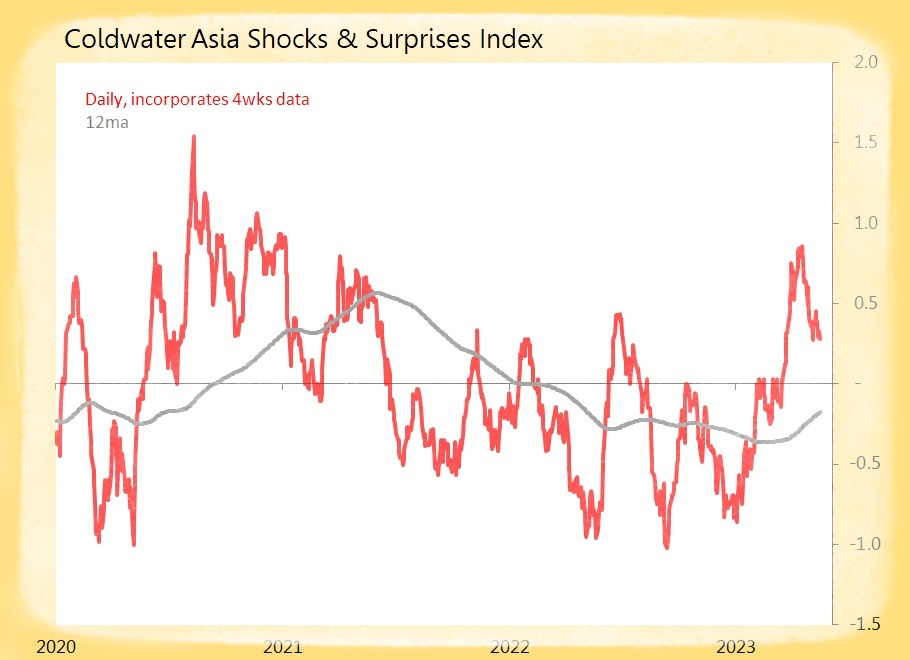

Summary: 29 datapoints tracked today, generating nine surprises and four shocks. Of those eight surprises, two of them - US industrial and manufacturing production - are of dubious provenance, depending crucially on significant downgrades for previous months. Still, they all count. . .

US (8 tracked)

Surprise! May NAHB Housing Market Index Jumps 5pts to 50

o Best Since July 2022

o Current Sales up 5pts to 56, 6m Expected Sales up 7pts to 57

o Prospective Buyers’ Traffic up 2pts to 33

o South up 5pts to 55, West up 8pts to 48

o Midwest up 2pts, Northeast up 1pt

Surprise! April Industrial Production Rises +0.5% mom and +0.2% yoy

o Surprise Only Reflects Revisions Down for Feb and March to Zero from +0.2% and 0.4% initially

o April is First Monthly Rise since Jan

o Business Equipt +1.2% mom, Consumer Goods +0.6%, Non-Industrial Supplies Unchanged

o Construction Materials +0.4% mom, Materials +0.4%

o Manufacturing +1% mom, Mining +0.6%, Utilities Down 3.1%

Surprise! April Manufacturing Production Rises +1% mom but Down 0.9% yoy

o Surprises Only Reflects Revisions Down for Feb to 0.3% (vs 0.6%) and March to Down 0.8% (vs Down 0.5%)

o Drivers: Autos +9.3% mom, Computer & Electronics +2.1%, Rubber & Plastics +1.2%

o Drag: Misc Manufacturing Down 1.4% mom

Europe (14 tracked)

Surprise! Eurozone 1Q Employment Rises +0.6% qoq and +1.7% yoy

o GDP Rises 0.1% qoq and 1.3% yoy

o GDP per Employee Falls 0.5% qoq and Falls 0.4% yoy

Surprise! Eurozone March Non-Seasonally Adjusted T-bal Shows Eu25.6bn Surplus

o Exports +7.5% yoy, with Monthly Movt 0.7SDs Above Historic Seasonal Trends

o Imports Down 10% yoy, with Monthly Movt 0.3SDs Below Trend

Surprise! Eurozone March T-bal Seasonally Adjusted T-bal Shows Eu17.1bn Surplus

o Trade Surplus Rises Eu17.2bn mom

o Exports Down 0.1% mom sa, but Imports Down 7.1%

o Germany Surplus up eu1bn to Eu21.5bn, with Netherlands Deficit Down 1.8bn to Eu15.7bn

o France Balance Improves Eu3.2bn mom to Eu2.9bn Surplus

o Italy Surplus Rises Eu3.6bn mom to Eu6.9bn

o Spain Deficit Closes Eu1.3bn mom to Eu3.5bn

Shock! Eurozone May Zew Survey Expectations Drop 15.8pts to Minus 9.4

o First Negative Result Since Dec 2022

o Cited: Likely ECB Interest Rate Rises; Fear of US Federal Default

o Current Conditions up 2.7pts to Minus 27.5

Surprise! UK March Av Weekly Earnings Rise +4.9% yoy

o Private Sector +4.6% yoy, Public Sector +5.6%, or 5.4% ex-Finance

o Highest Rises: Finance & Business Servs +6.7% yoy, Manufacturing +5.4%

o Lowest Rises: Construction +1.7%, Wholesale/Retail/Hostelry +1.9%

Asia (7 tracked)

Shock! China April Industrial Production Rises +5.6% yoy Only

o Base of Comparison V Friendly, Monthly Movt 1.3SDs Below Trend

o Mining +6.5% yoy, Electricity & Utilities +4.8%, Manufacturing +6.5%

o SOEs +6.6% yoy, Joint-Stock Dos +4.4%, Private +1.6%, but HK/Taiwan Invested +11.8%

o Drivers: Autos +44.6% yoy, Electrical Equipt +17.3%, General Equipt +13.5%

o Drags: Pharma Down 7.2% yoy, Textiles Down 3%, Computer/Comms Equipt +1.8%

Shock! China April Electricity Production Rises +6.1% yoy Only

o Base of Comparison V Friendly, Monthly Movt 1.5SDs Below Trend

o Drivers: Thermal +11.5% yoy, Nuclear +5.7%, Wind +20.9%

o Drags: Hydro Down 25.9% yoy, Solar Down 3.3%

Surprise! China Jan-April Urban Fixed Asset Investment Gains +4.7% ytd

o Private Investment +0.4% ytd

o Primary Industry +0.3% ytd, Secondary +8.4%, Tertiary +3.1%

o Manufacturing +6.4% ytd, with Electrical Machinery +42.1%, Autos +18.5%, Chemicals +15.5%

o Electricity & Utilities +24.4% ytd

o Domestic Cos +4.9% ytd, Foreign Invested +5.3%, but HK & Macao Down 4.3%

o Eastern +6.2% ytd, Northeast +9.8%, but West +3.2% and Central Down 1.3%

Surprise! S Korea April Export Prices Surprise Fall 7.5% yoy Only

o Monthly Rise of 0.1% mom is 0.3SDs Below Historic Seasonal Trends

o Rising Prices: Transport Equipt +9.9% yoy, Electrical Equipt +9.7%, Machinery +8.5%

o Falling Prices: Coal & Petroleum Products Down 20.5% yoy, Computers/Electronics Down 20.7%, Basic Metals Down 10.4%

o Import Prices +0.7% mom, so Terms of Trade Down 0.6% mom and Down 1.9% yoy

Shock! S Korea April Import Prices Drop Down 5.8% yoy Only

o Monthly Rise of 0.7% mom is 0.3SDs Above Historic Seasonal Trends

o Manufacturing Products +1.1% mom and Down 3.1% yoy Only

o Rising Prices: Non-Metallic Minerals +10.6% yoy, Electrical Equipt +7.1%, Machinery +7.9%

o Falling Prices: Coal & Petroleum Products Down 25.7% yoy, Basic Metals Down 8.1%, Chemicals Down 1.7%