Macro Kernel - 11th May

Notable Today

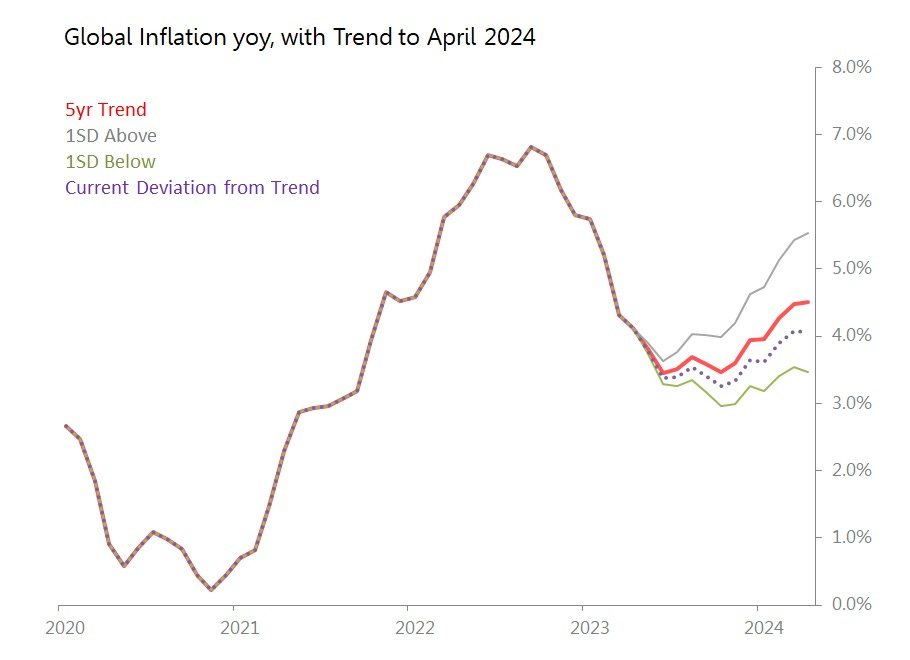

Inflation is not yet conquered. Unless there is an anomalous deflationary shock which breaks the underlying inflationary trends established over the last five years, we are in the last few months when we should expect yoy comparisons to fall. The bottom can come as early as June, or as late as November, but in all plausible trajectories based on 5yr trends, there is no return to pre-covid levels of inflation.

This global CPI index is constructed from weighted results from US, Eurozone and NE Asia (China, Japan, S Korea, Taiwan), and shows how the yoy comparisons will develop if the deflections against 5yr seasonal trends seen over the last six months are continued, as well as what happens if CPI conforms to trend, or rises or falls 1SD from those underlying trends.

None of those trajectories allow global CPI to keep falling as it has since the middle of last year. Essentially, the bases of comparison stop being so friendly, which arrests the fall in headline CPI. If CPI maintains 5yr trends, this will mean yoy comparisons begin to rise once again in the second half of this year. If current deflections below trend are maintained, inflation bottoms out slightly later, but then also resumes a modest rise.

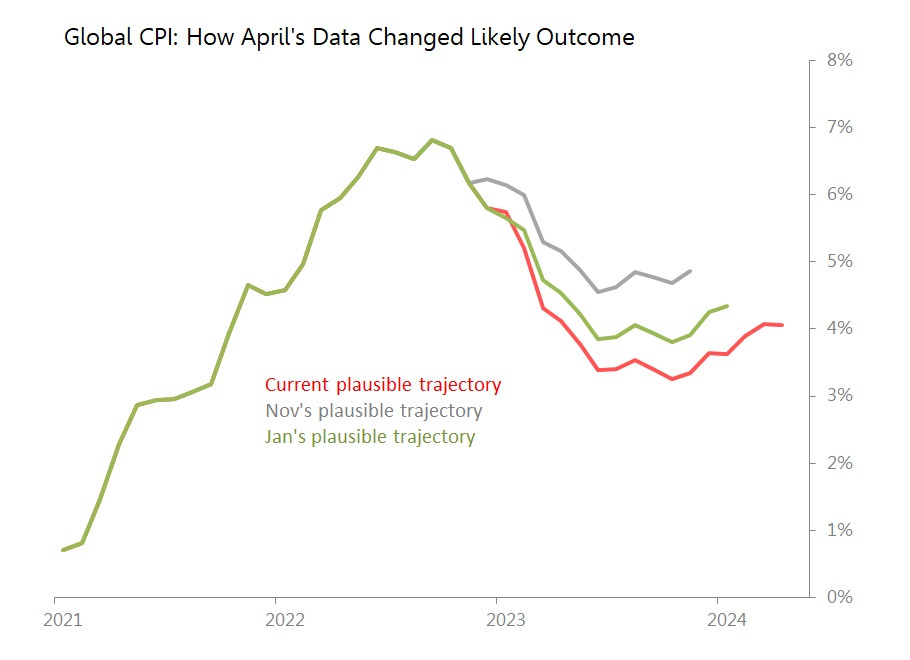

For the first time since I started tracking the changes in plausible outcomes, April’s global data implied no retreat in plausible global CPI trajectory for the coming year. Note

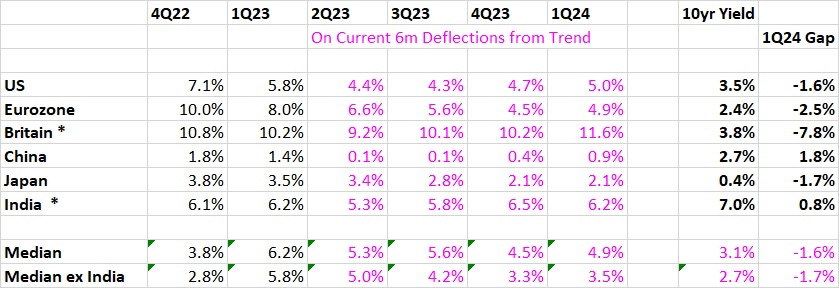

For the details of what April’s results meant for individual economies:

The Eurozone’s 7% yoy was the only unambiguously positive result, lowering the likely CPI trajectory over the coming year by 40-50bps. In every other region, April’s results raised the likely trajectory modestly.

In the US, April’s 4.7% rise did not have a dramatic impact, but raised the 12m trajectory by around 10bps.

Japan’s result, modelled from Tokyo’s 3.5% yoy rise, did have a significant impact, raising the likely 12m trajectory by around 80bps. Japan’s 10yr yields, then, are at the same sort of discount to inflation as in the US.

China’s 0.1% yoy rise in April had a modestly negative impact, raising the 12 plausible trajectory by 20-30bps.

(NB, neither the UK nor India has yet reported April’s CPI - but neither are included in the global CPI calculation.)

Plausible Inflationary Trajectories

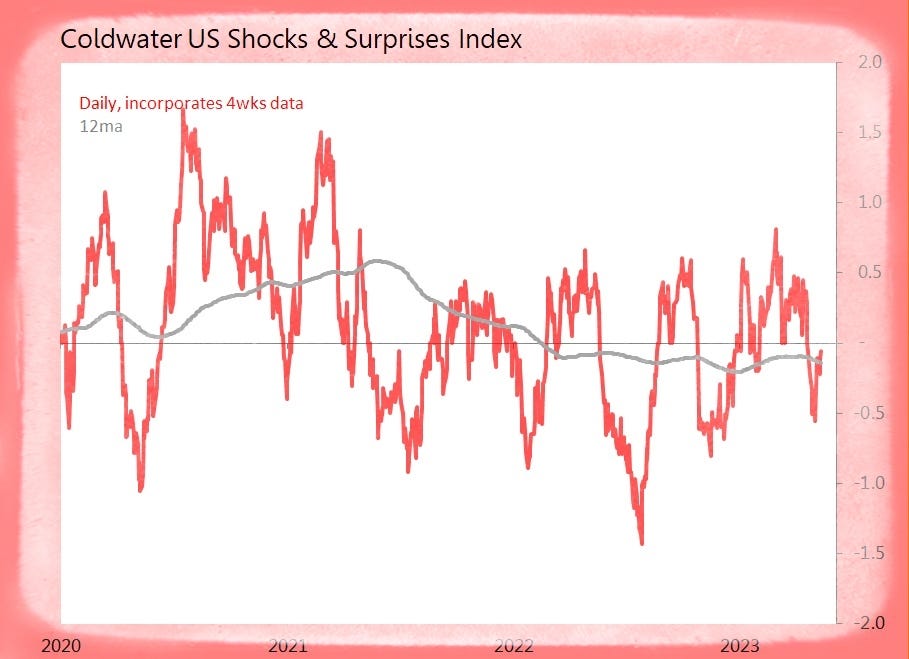

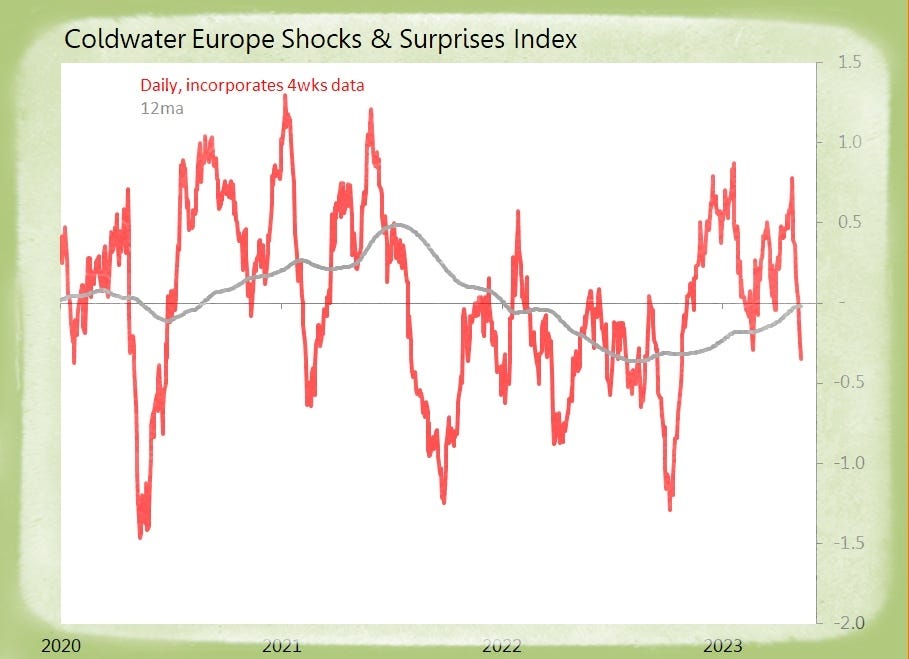

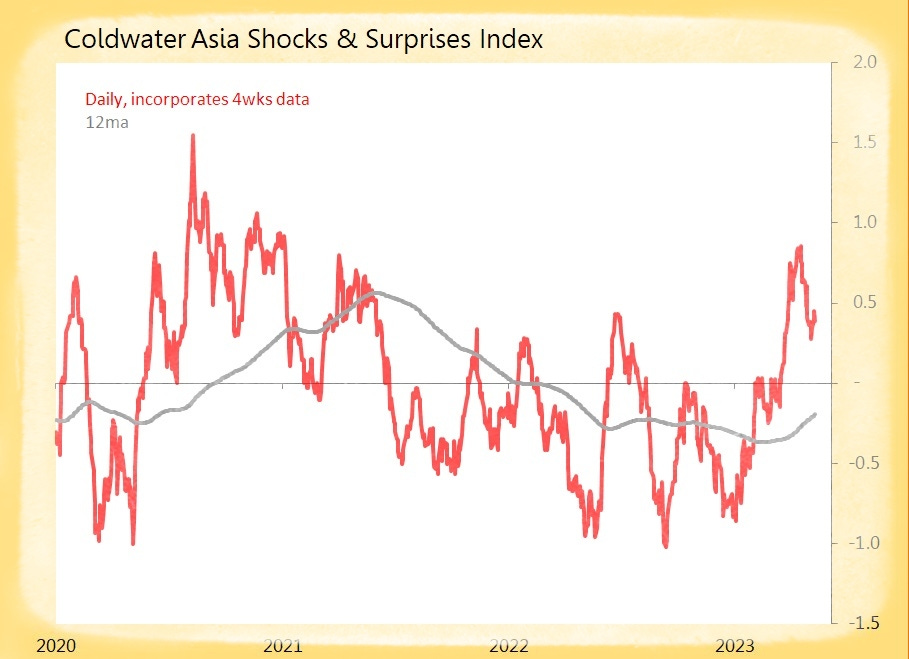

Summary: Only 13 datapoints today, with Europe’s statisticians taking the day off. Two surprises and one shock.

US (5 tracked)

Shock! Weekly Initial Jobless Claims Rise 22k to 264k

o Most Since Jan 2022

o Largest Rises: Massachusetts +3.8k, Kentucky +3.7k, Pennsylvania

o Largest Falls: New York Down 9.5k, Illinois Down 2.7k, Georgia Down 1.3k

Surprise! Weekly Total Benefits Claimants Fall 63.9k to 1.715mn

o Regular State Benefits Down 63k

o Small Falls in STC/Workshare, Federal Employees

o Small Rises in Extended Benefits, State Additional Benefits

Europe

No Data This Day

Asia (8 tracked)

Surprise! China April Output PPI Falls 3.6% yoy

o Monthly Fall of 0.4% mom is 0.8SDs Below Historic Seasonal Trends

o Input PPI Down 4.7% yoy, with Mining Down 8.5%, Raw Materials Down 6.3%, Processing Down 3.6%

o Output Price Falls: Oil & Gas Down 16.3% yoy, Iron & Steel Processing Down 13.6%, Refinery Down 11.4%

o Rising Prices: Electricity +1.6% yoy, Gas +1.4%